- Reversal Patterns

- Continuation Patterns

- Neutral Patterns

Types of CHART

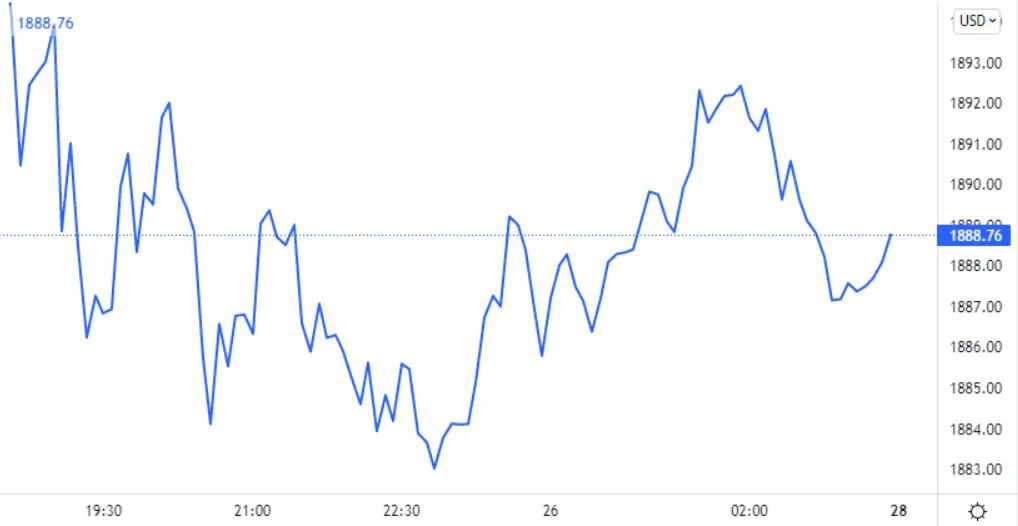

Dealing with large amounts of market or business data can be overwhelming, particularly when sifting through numerous figures in trade books or spreadsheets. This is where data visualization comes in.

In the stock market, data visualization is crucial for making informed decisions. Time series charts, such as line charts, candlestick charts, and bar charts, are commonly used for technical analysis.

These charts illustrate stock price changes over time, enabling traders to make informed decisions based on their individual preferences and strategies.

By using data visualization, traders can quickly and easily make sense of complex data and react to changes in the market. So next time you're faced with a pile of numbers, remember the power of data visualization.