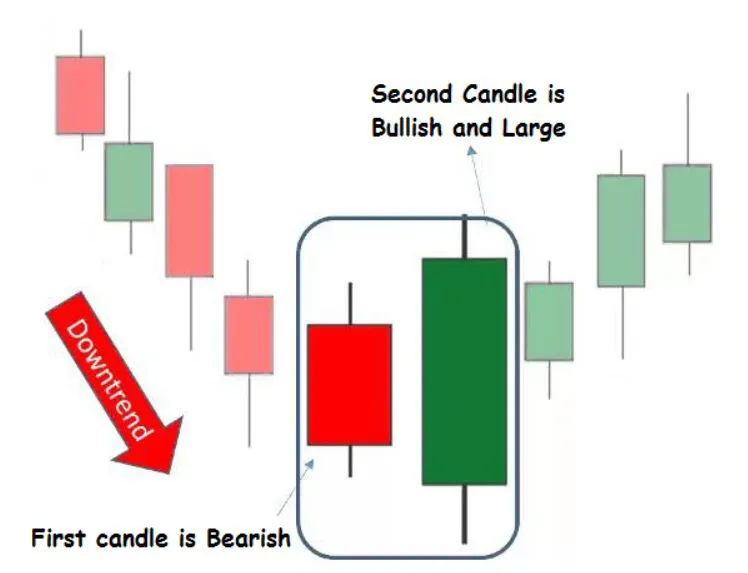

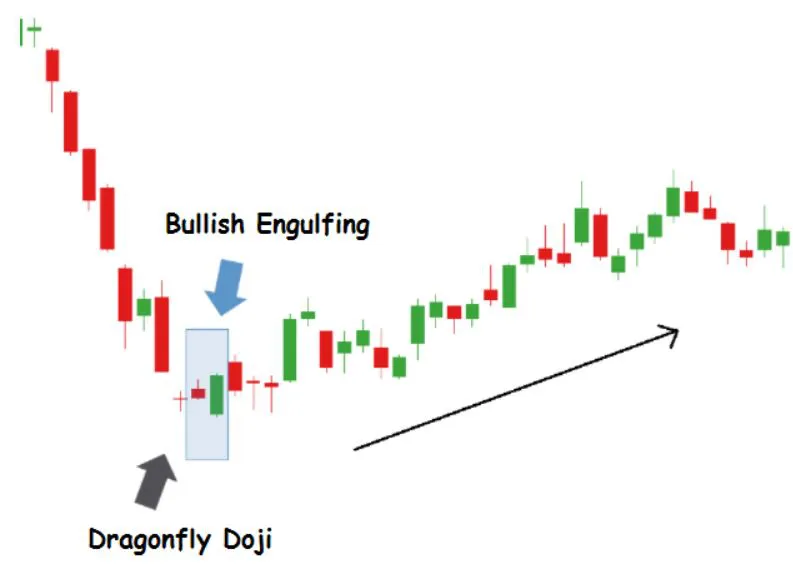

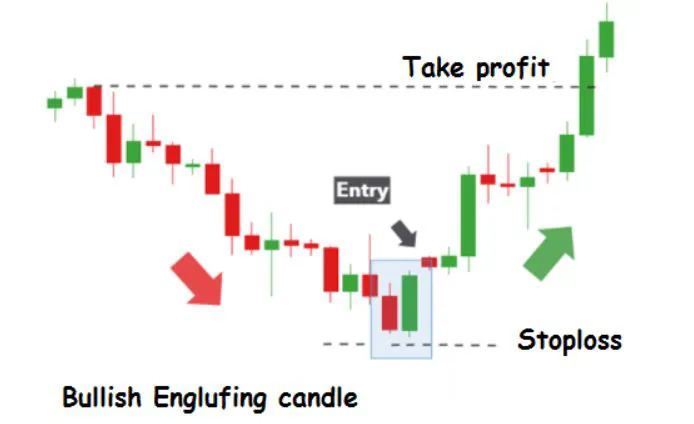

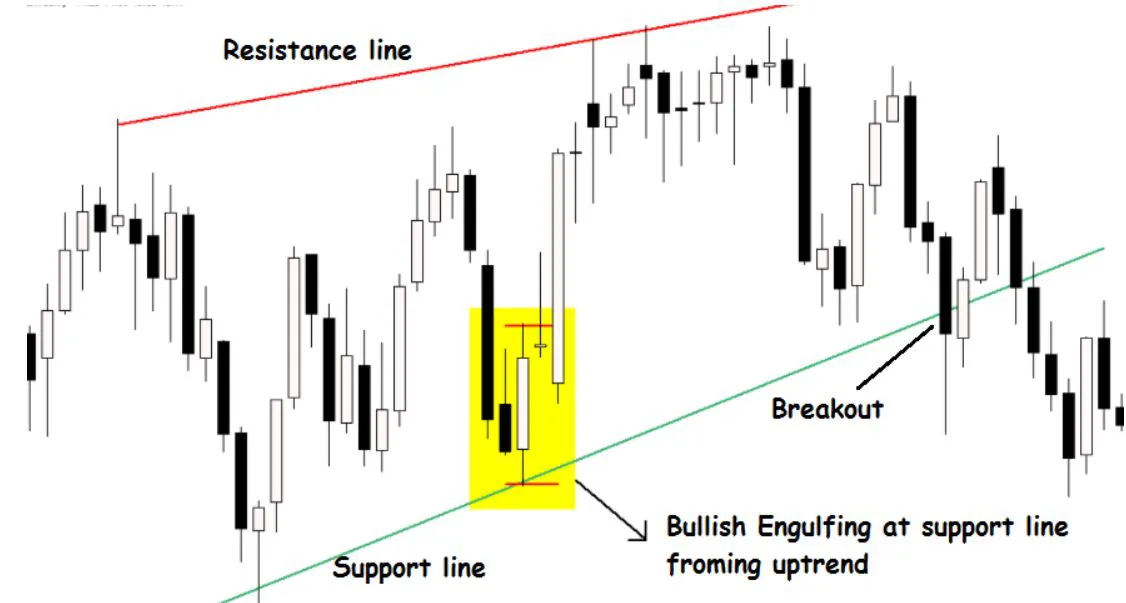

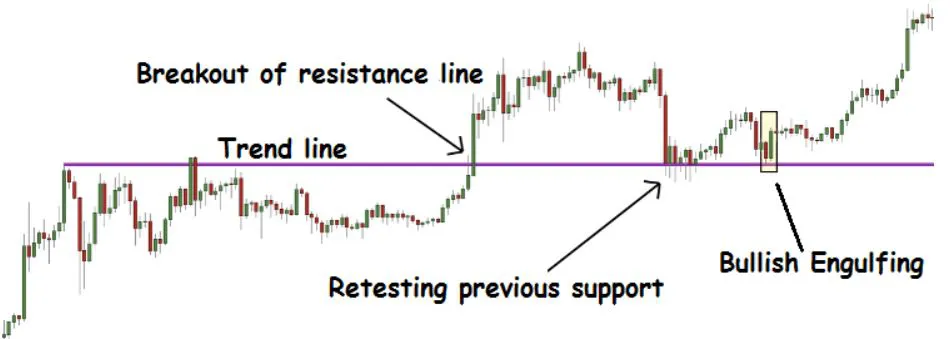

- Bullish Engulfing

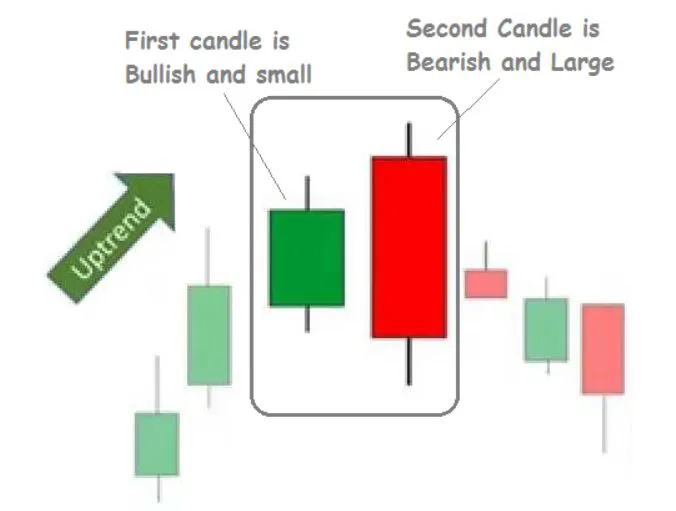

- Bearish Engulfing

ENGULFING

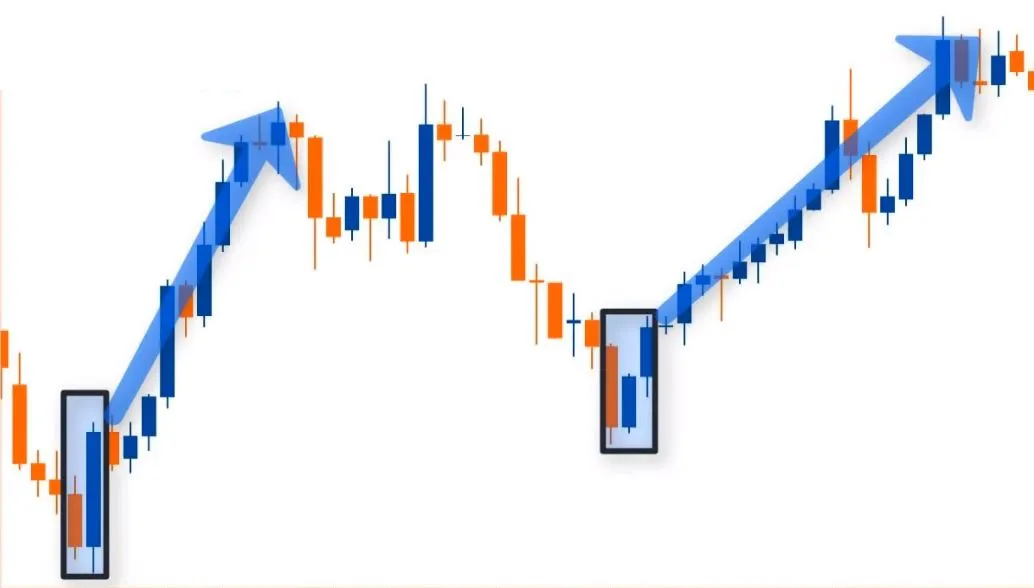

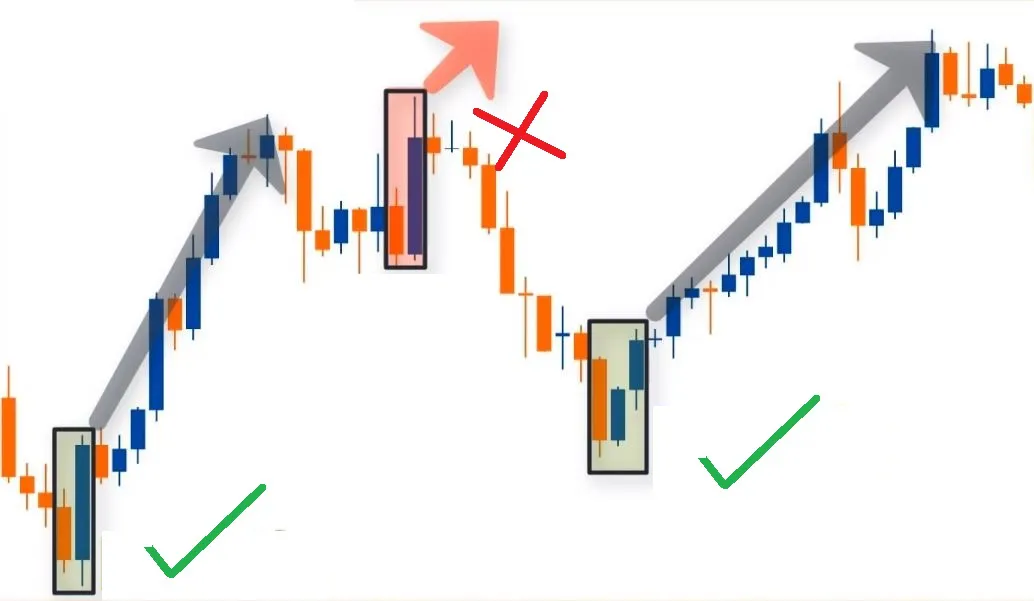

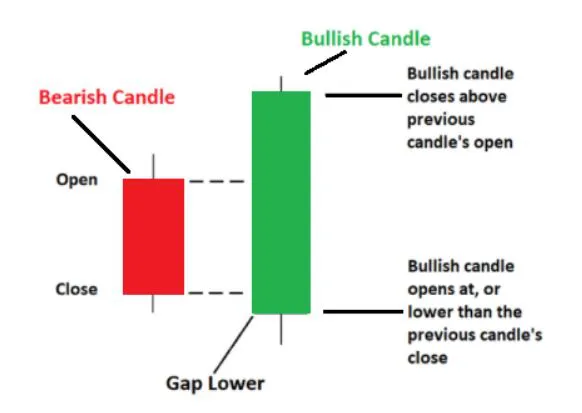

The Engulfing candlestick is a pattern that involves two candles and can signal a reversal in the trend.

The Engulfing candlestick pattern is a two-candle pattern that can signal a reversal in the current trend. It occurs when a small candlestick is completely engulfed by a larger candlestick that follows it, suggesting a possible shift in market sentiment.

In simple terms, engulfing means cover or eat completely. Here the second candle completely covers or "eats up" the first candle. So the name Engulfing Candles.