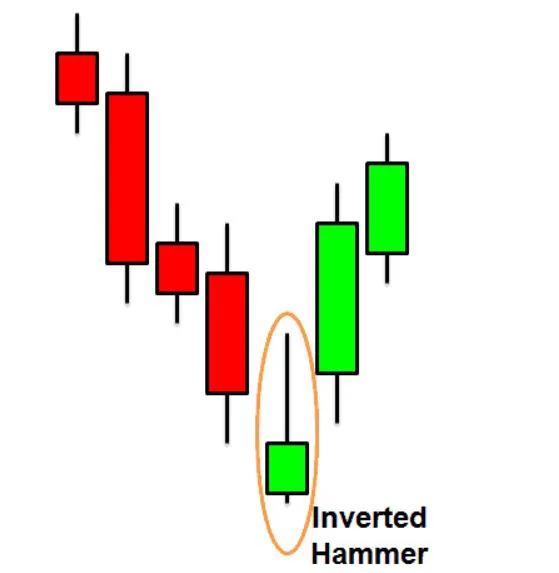

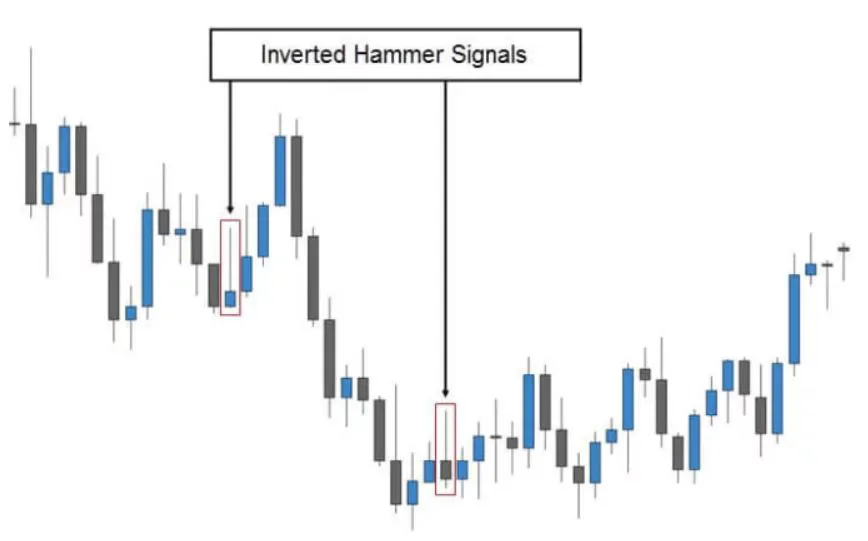

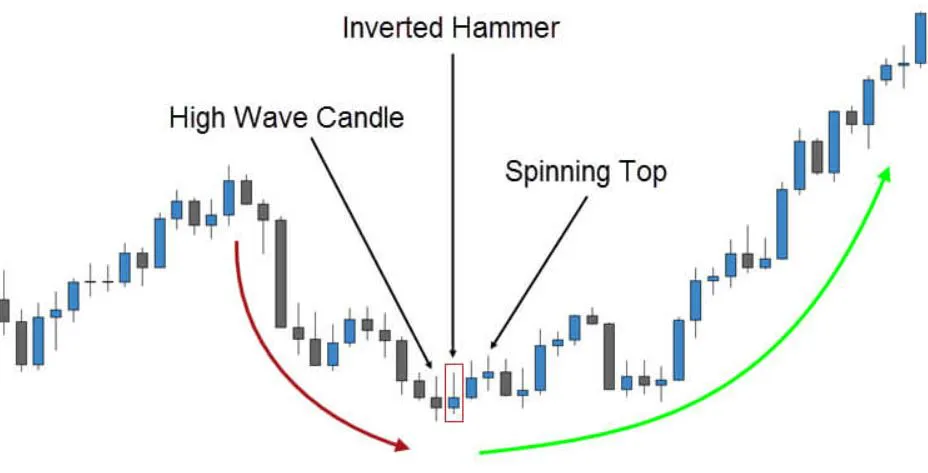

- Inverted Hammers pattern must be seen at the bottom of a downtrend.

- Inverted Hammers can be used as signals for trend reversal and exit signals for short positions.

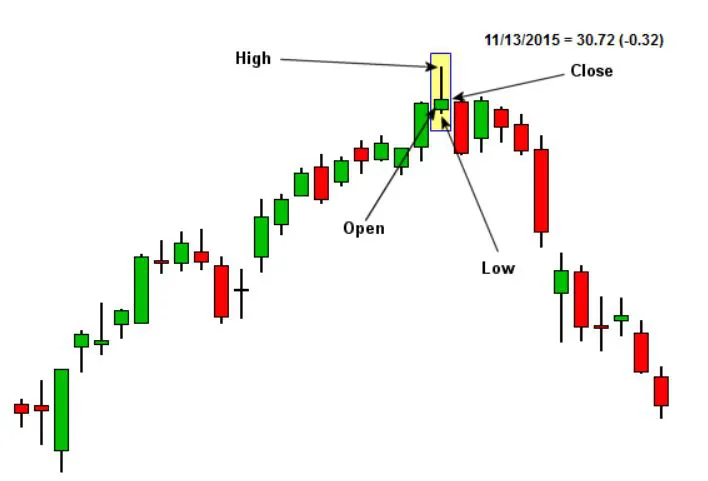

- The bottom or close of an Inverted Hammer can be considered as a support line.

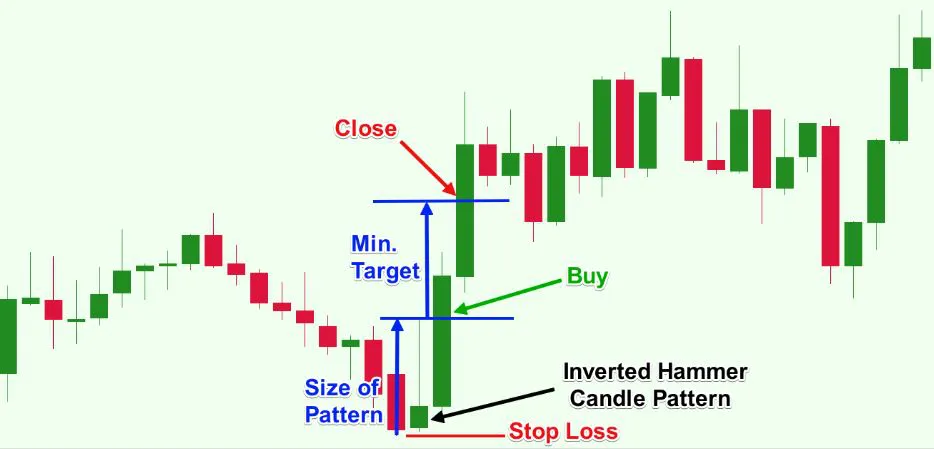

- Inverted Hammers do not provide a specific target, but indicate that traders are interested in reversing the trend.

- The color of the body of the Inverted Hammer pattern does not matter.

- The Inverted Hammer pattern fails if the next candlestick achieves a new low.

- It's important to note that Inverted Hammers are not stronger than regular Hammers.

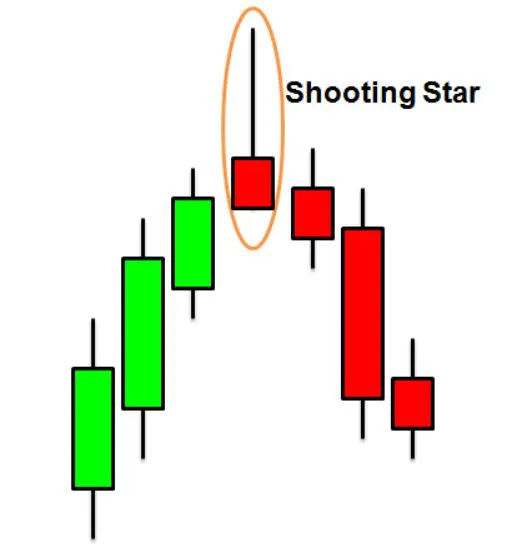

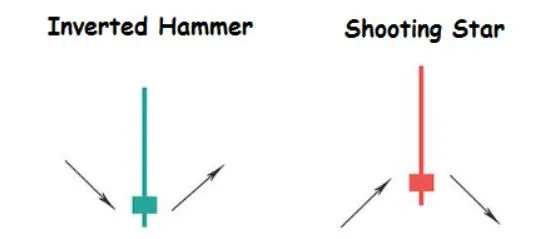

Inverted Hammer

vs

Shooting Star

An Inverted Hammer and a Shooting Star candlestick pattern look almost the same, but the only difference is the trend in which they appear

- Inverted Hammer appears in a downtrend

- Shooting Star appears in an uptrend.

Both Inverted Hammer and Shooting Star candlesticks have small bodies, long upper shadows/wicks, and small or no lower shadows/wicks.

Both patterns have similar shapes, but they have different implications for the market.