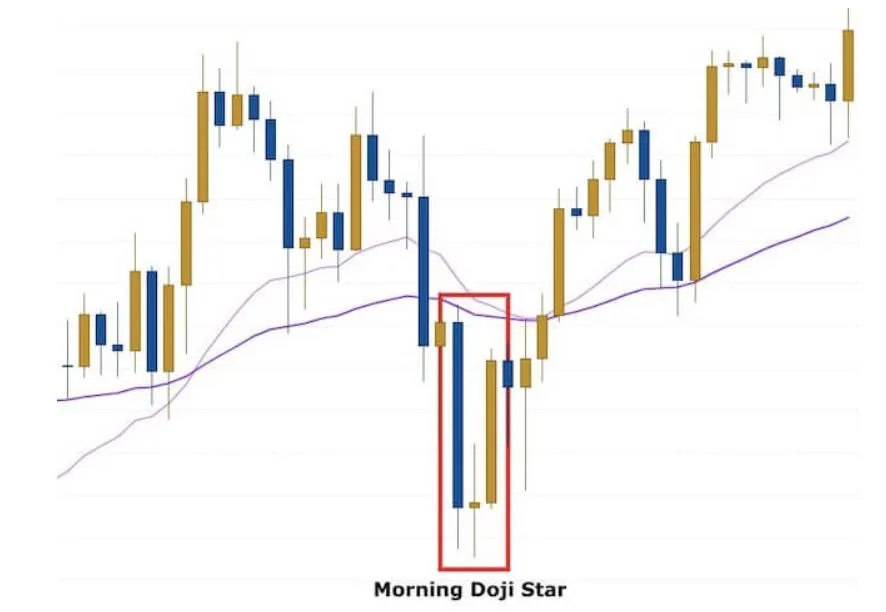

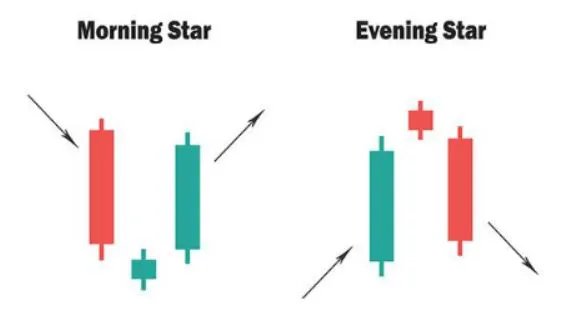

- Morning Star

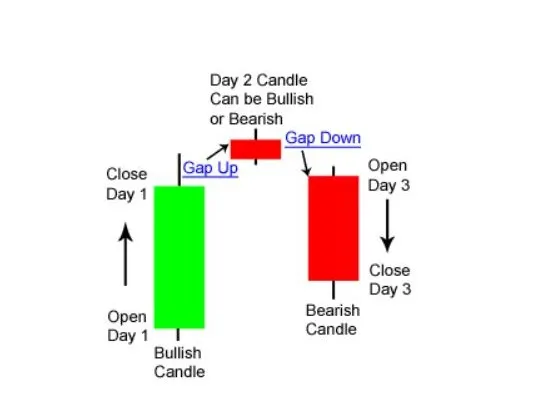

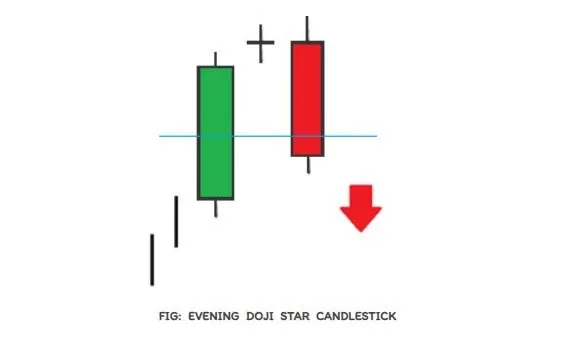

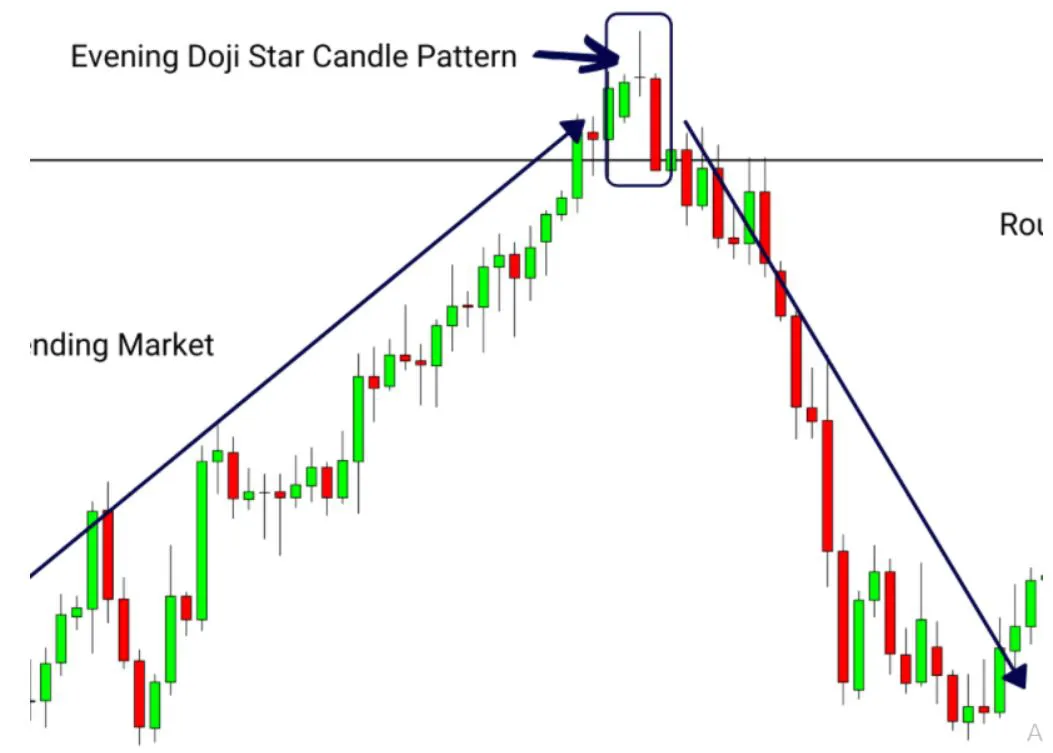

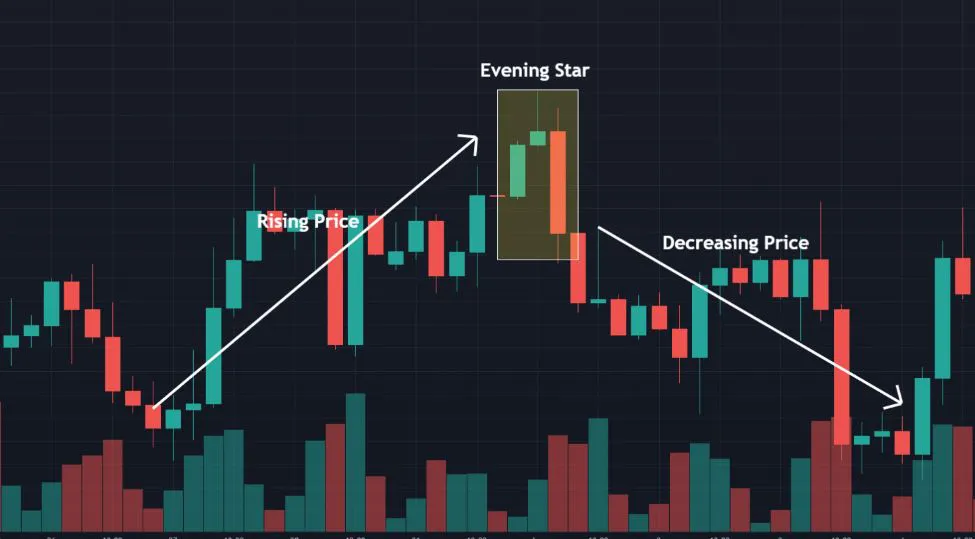

- Evening Star

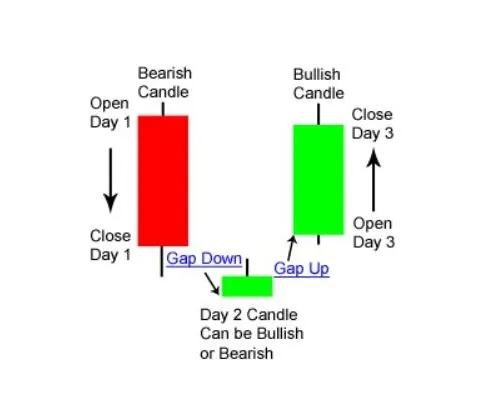

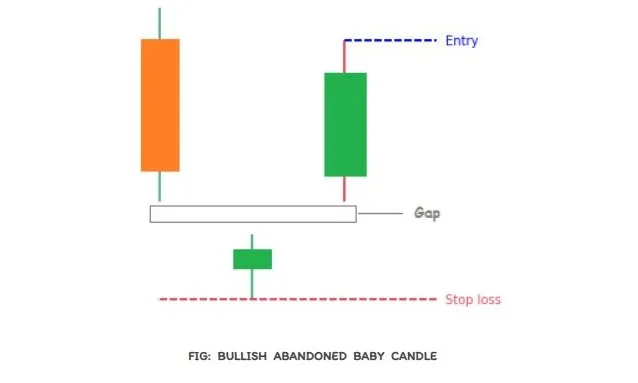

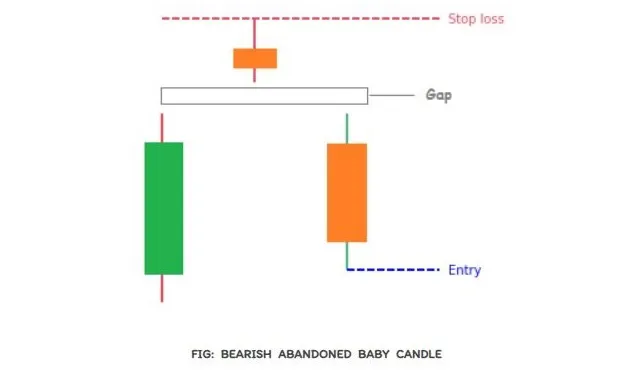

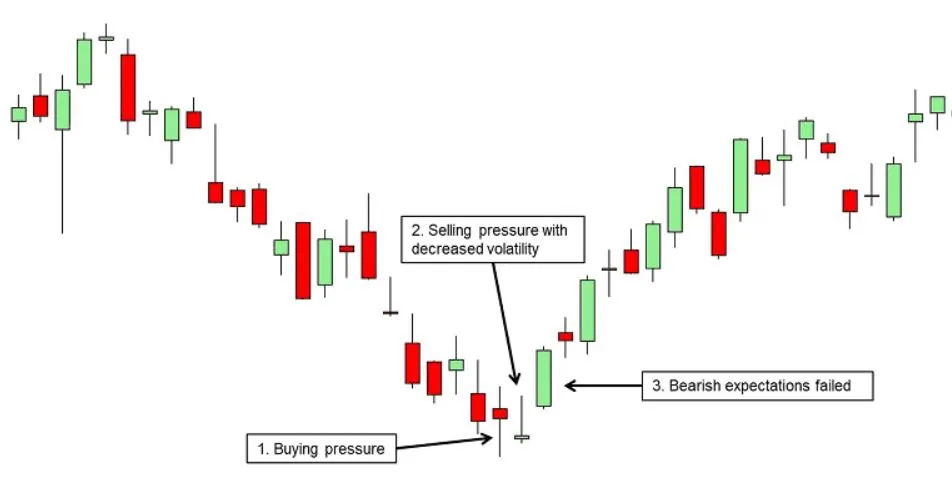

Star pattern candlesticks consists of three candles and can appear after a particular trend. Star candles are small-bodied candles that have a gap up or down from the previous candle on the chart. They can signal a strong reversal in the trend

For a star candlestick pattern, the middle candle should open with a gap up or down depending on the trend.