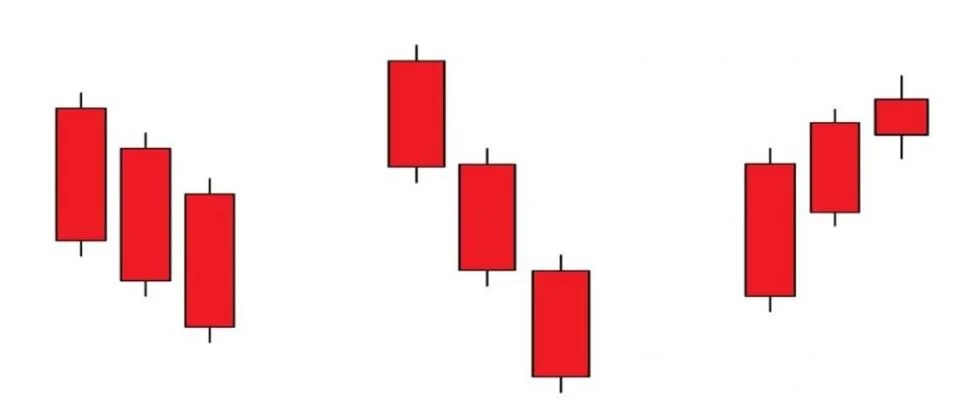

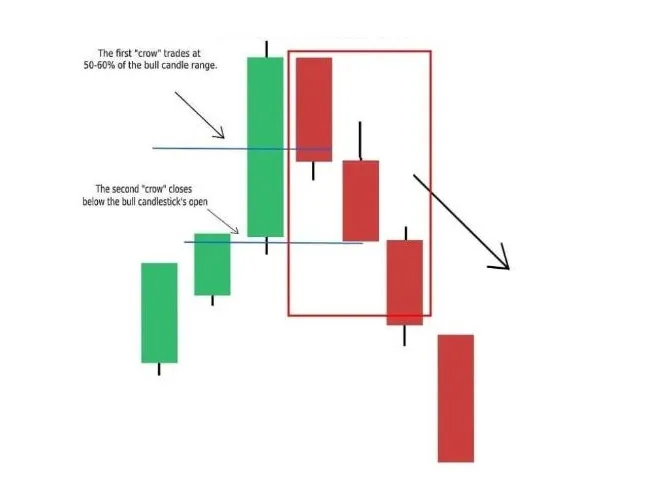

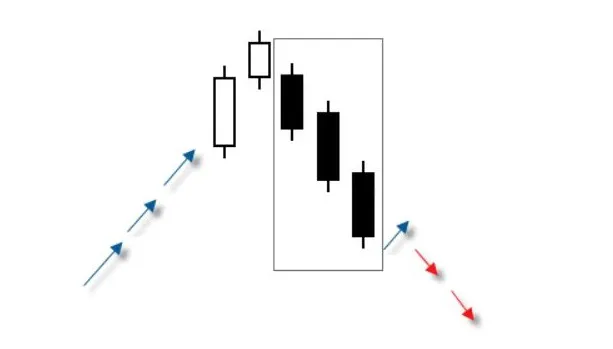

- Each candlestick should open lower than the previous day's open.

- The closing price of each candlestick should be near its low, indicating bearish momentum.

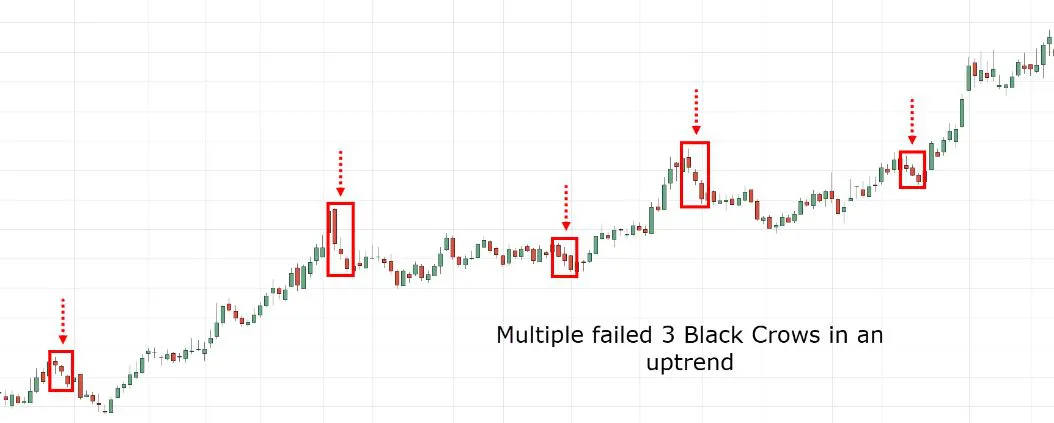

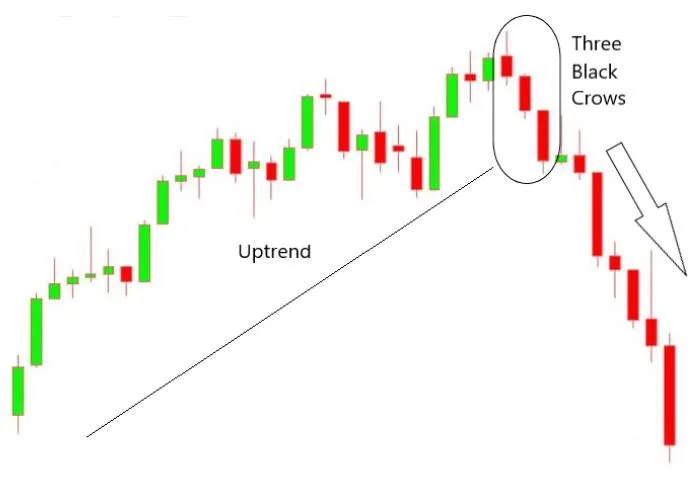

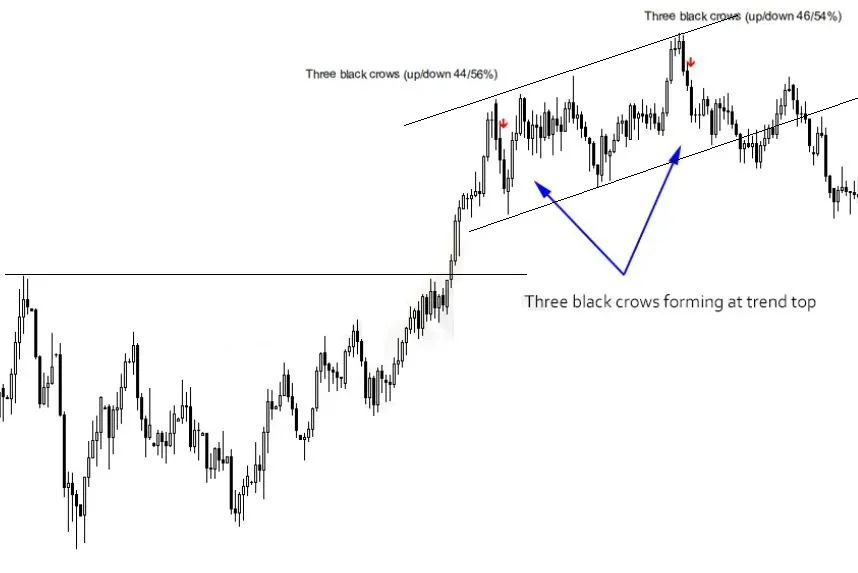

- The pattern typically occurs in an uptrend and signals a potential reversal of the trend.

- Traders often look for this pattern as a signal to enter short positions or to close long positions.

- Stop loss orders can be placed above the high of the last candlestick in the pattern to manage risk.

- A technical trader may take the three black crows as an opportunity to open a short position to attempt to profit from the following bear run.

Three Black Crows

The Three Black Crows pattern is the opposite of the three white soldiers.

The "Three Black Crows" is a bearish candlestick pattern that indicates a potential reversal of an uptrend. It consists of three consecutive long-bodied candlesticks with small or no wicks, each opening lower than the previous day's open and closing near its low.

The pattern suggests that sellers have taken control of the market and are willing to push the price lower. Traders often look for this pattern as a signal to enter short positions or to close long positions.