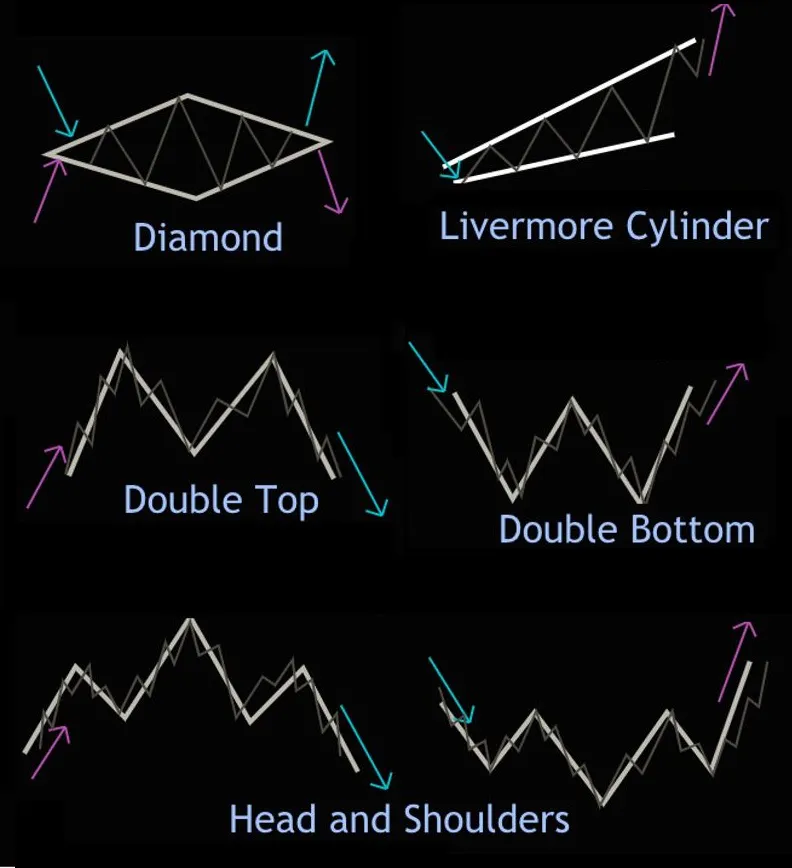

- Reversal Patterns

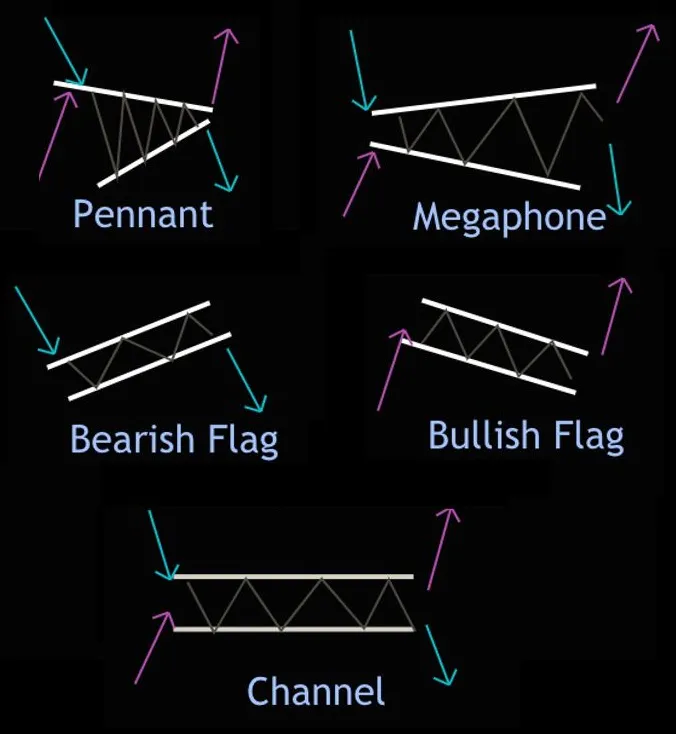

- Continuation Patterns

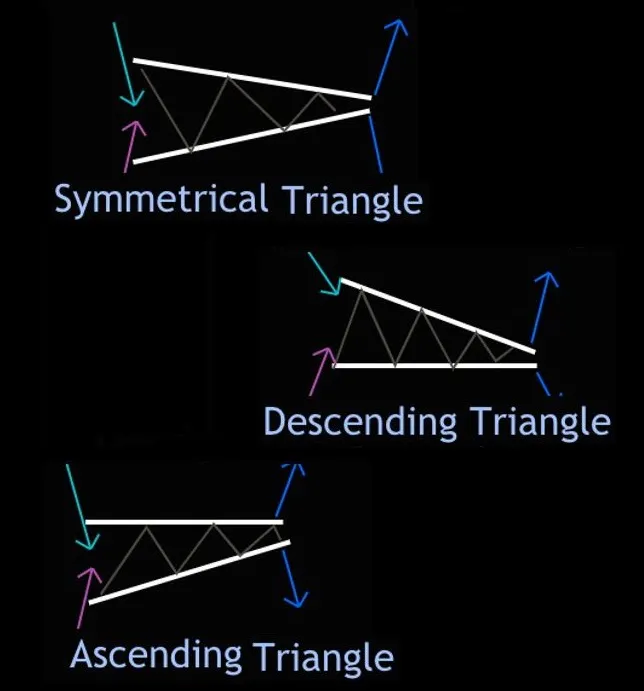

- Neutral Patterns

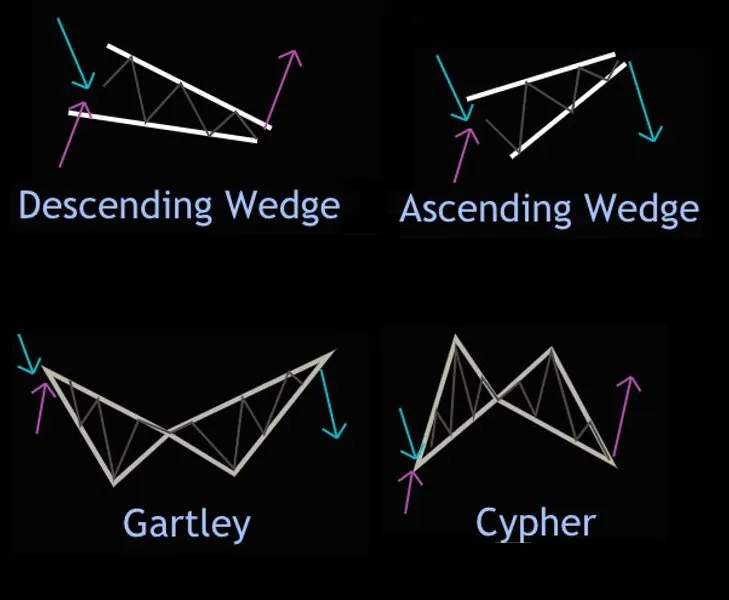

Trend Patterns

Patterns in trading refer to specific formations or movements that can be identified on price charts by analyzing historical price and volume data. Traders use patterns to predict future price movements and make trading decisions.