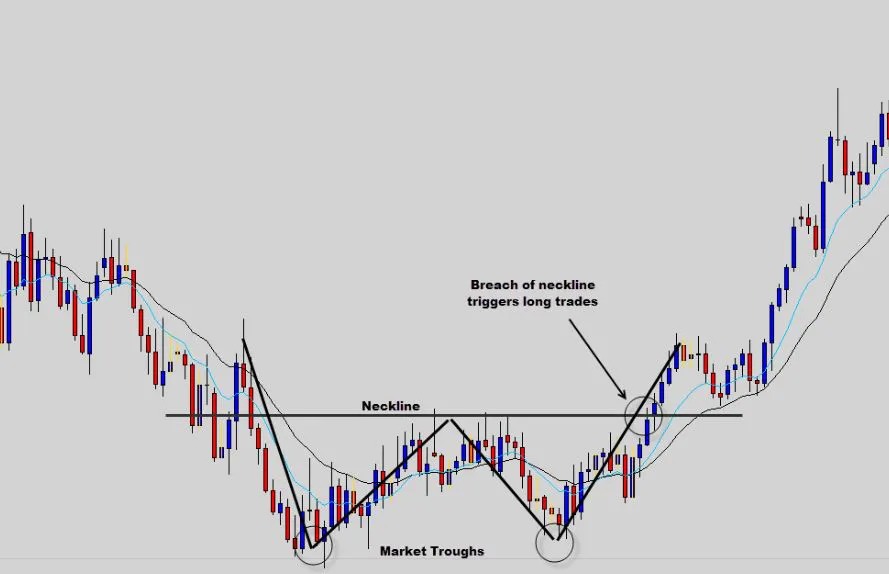

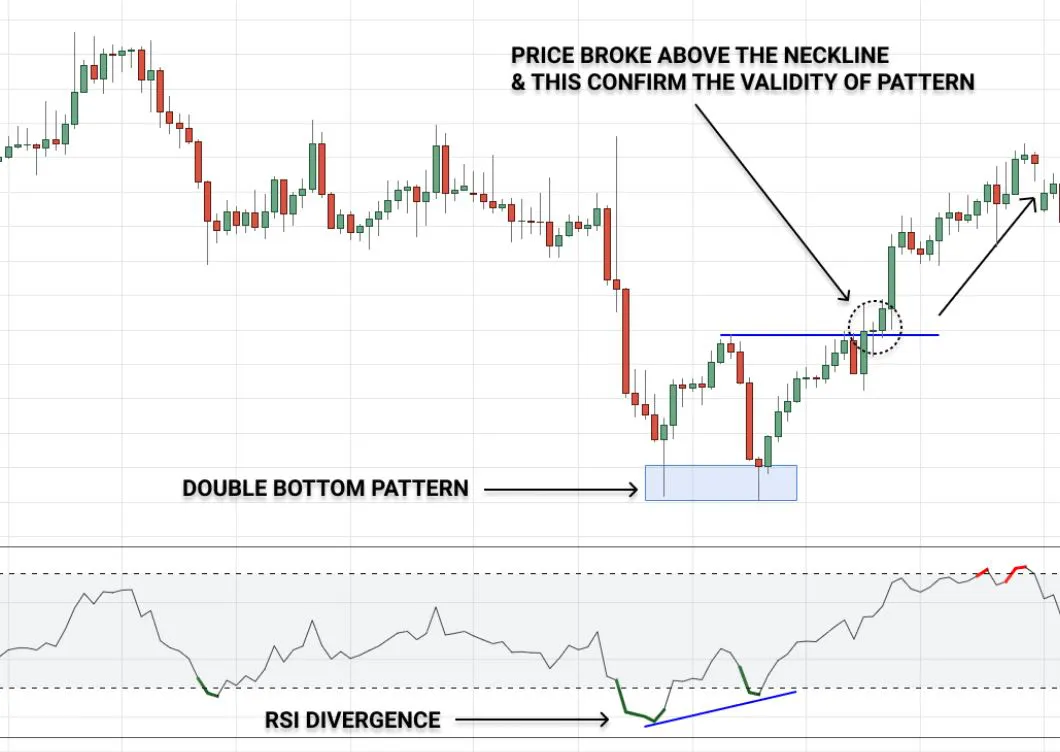

How Double Bottom formed?

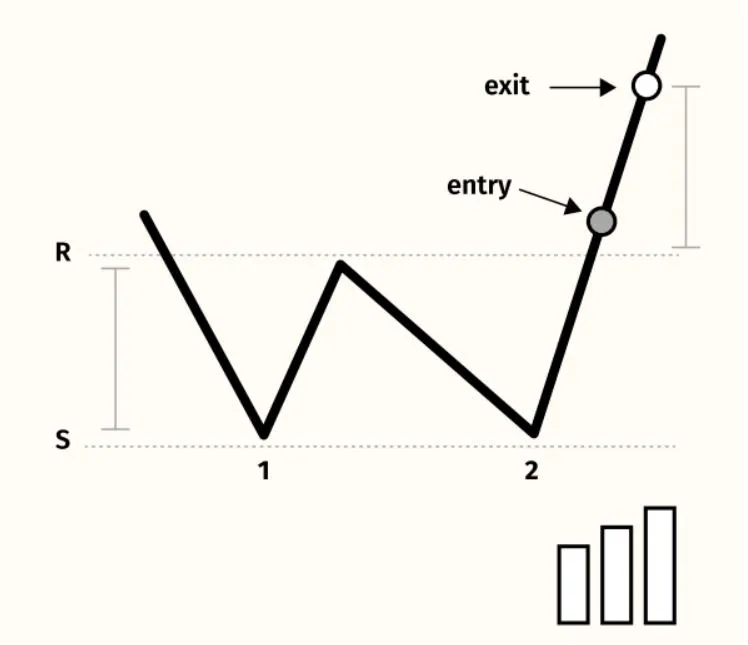

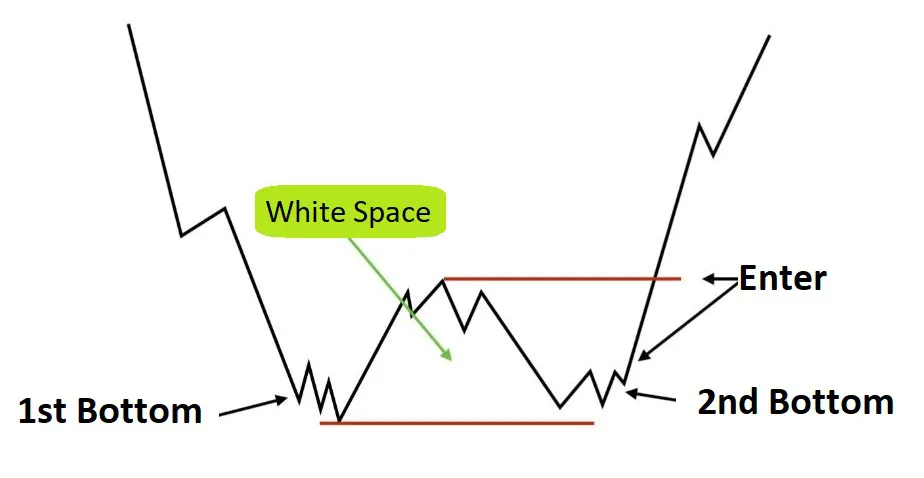

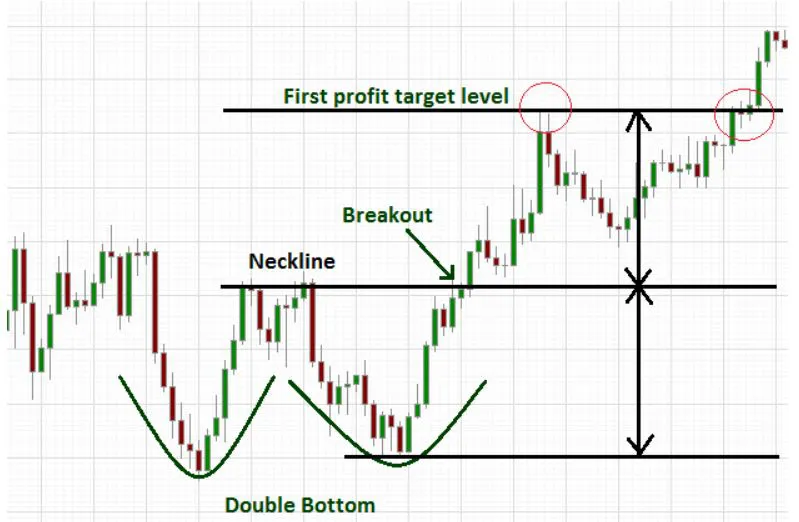

- After a strong downward trend, the price reaches a low point (the first bottom) and starts to go up.

- The price then goes down again, but not as far as the first time (the second bottom).

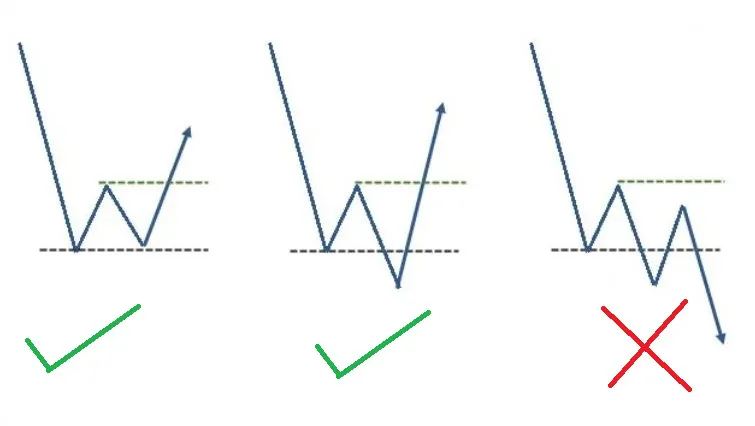

- When the price starts to go up again and reaches the same level as the first bottom, that's called the neckline.

- If the price goes up past the neckline, that's a sign the trend is changing, and prices could continue to rise.