How Double Bottom formed?

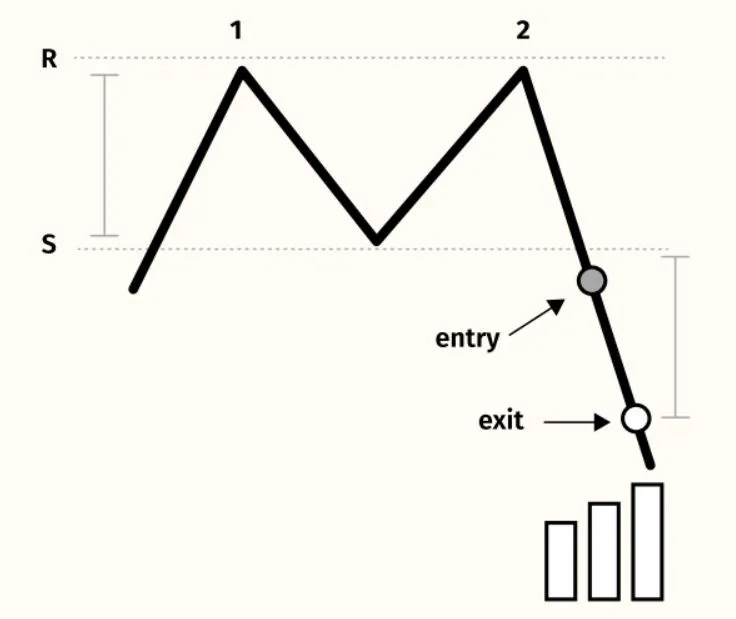

- When the market is in a strong bullish trend, with prices steadily increasing. The price reaches a high point, and then starts to pull back forming first Top

- The price finds support at a certain level, which creates a valley and pulls up.

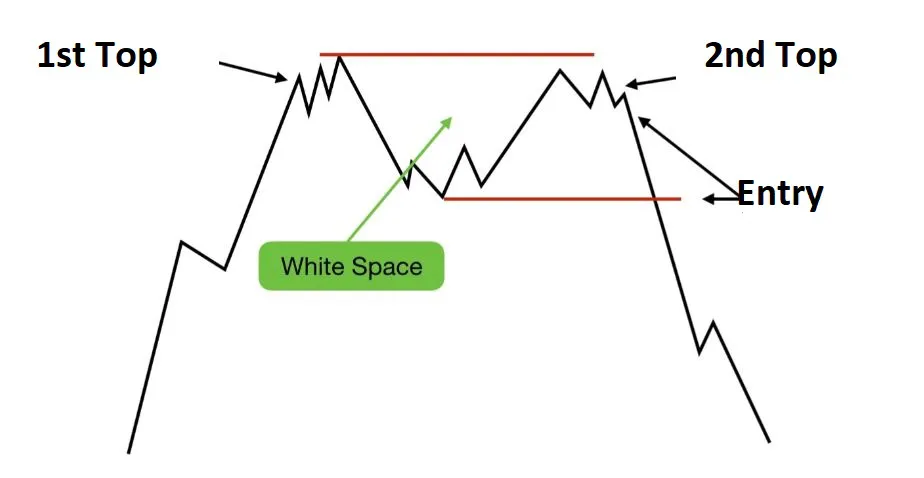

- The price then rises again, but fails to reach the previous high and begins to fall again.

- The support level created by the valley connects the two high points, forming the neckline.

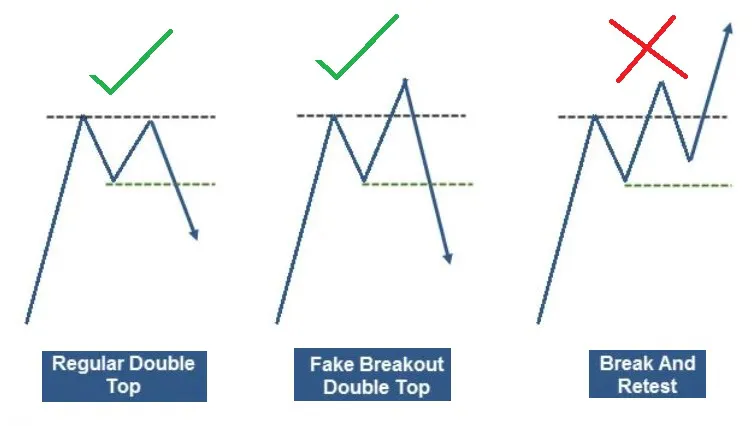

- If the price falls below the neckline, it signals a potential trend reversal and a bearish move.

- Increase in volume near the Neck line determines the perfect breakout