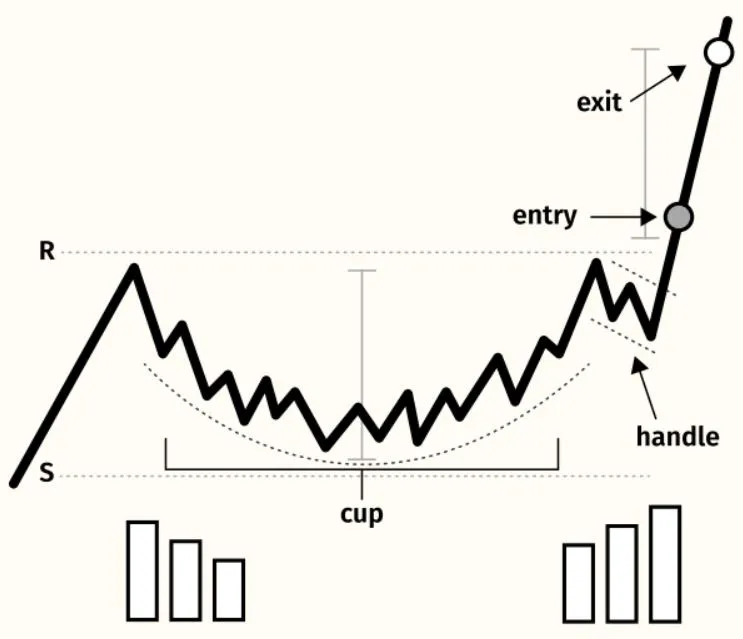

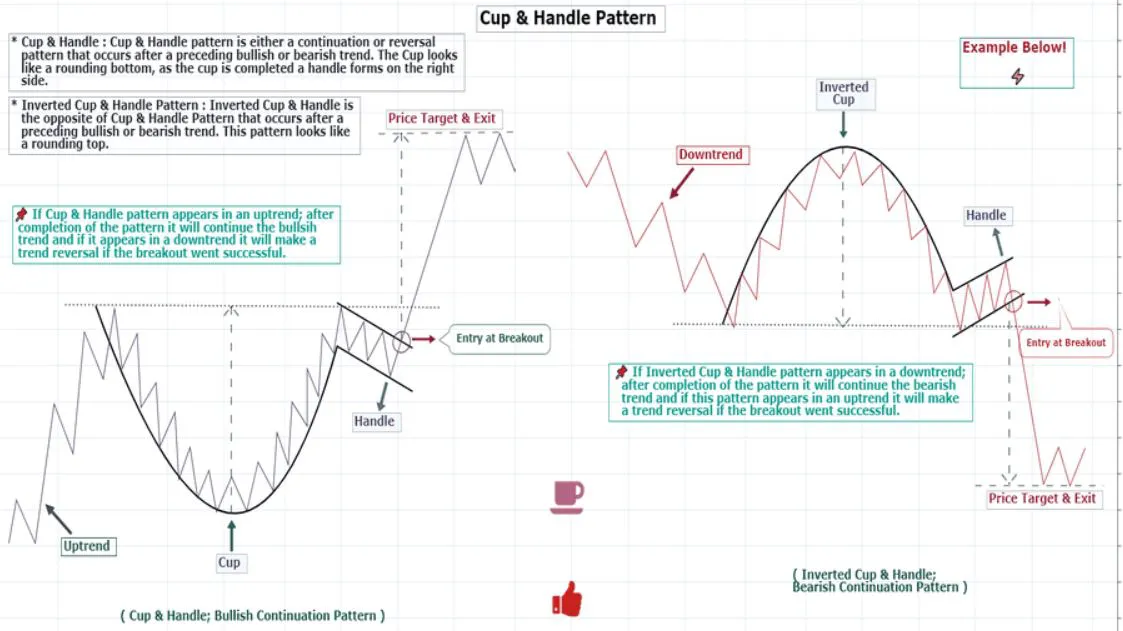

- Regular Cup & Handle

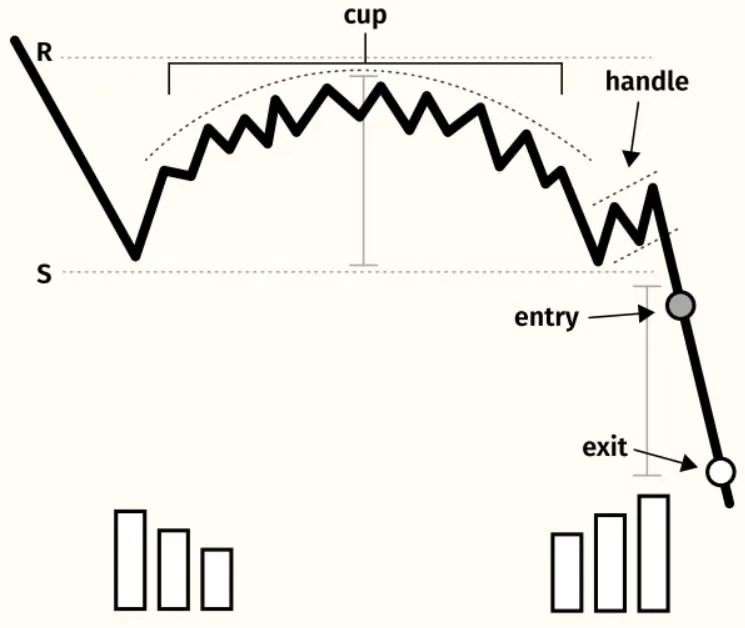

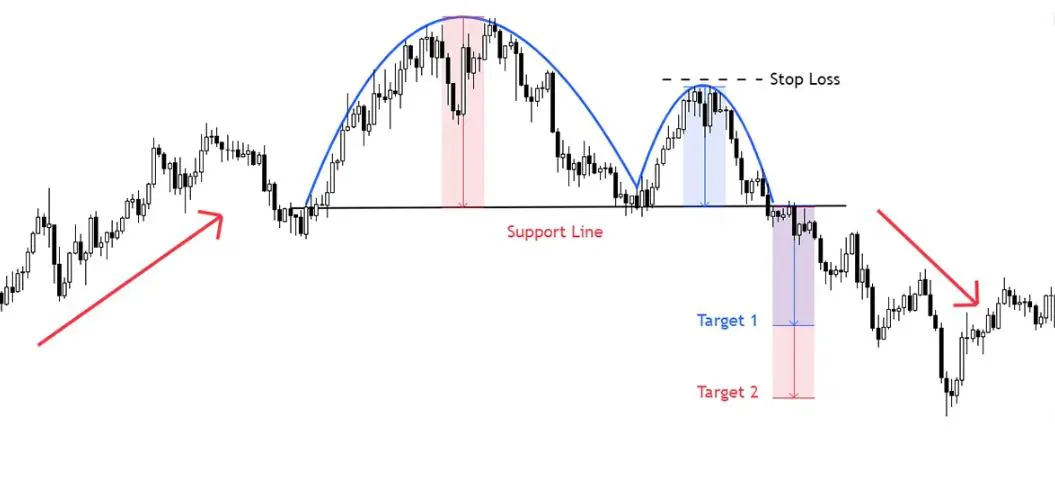

- Inverted Cup & Handle

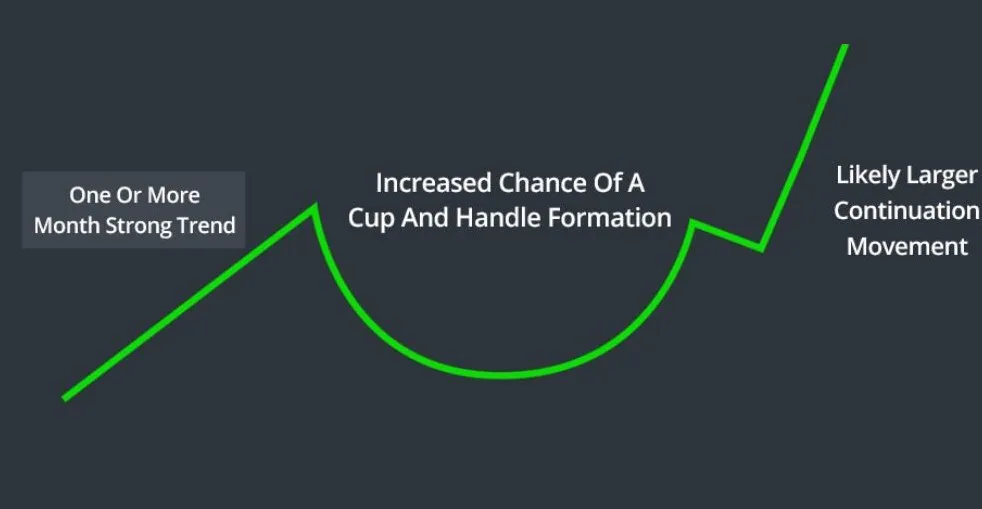

CUP AND HANDLE

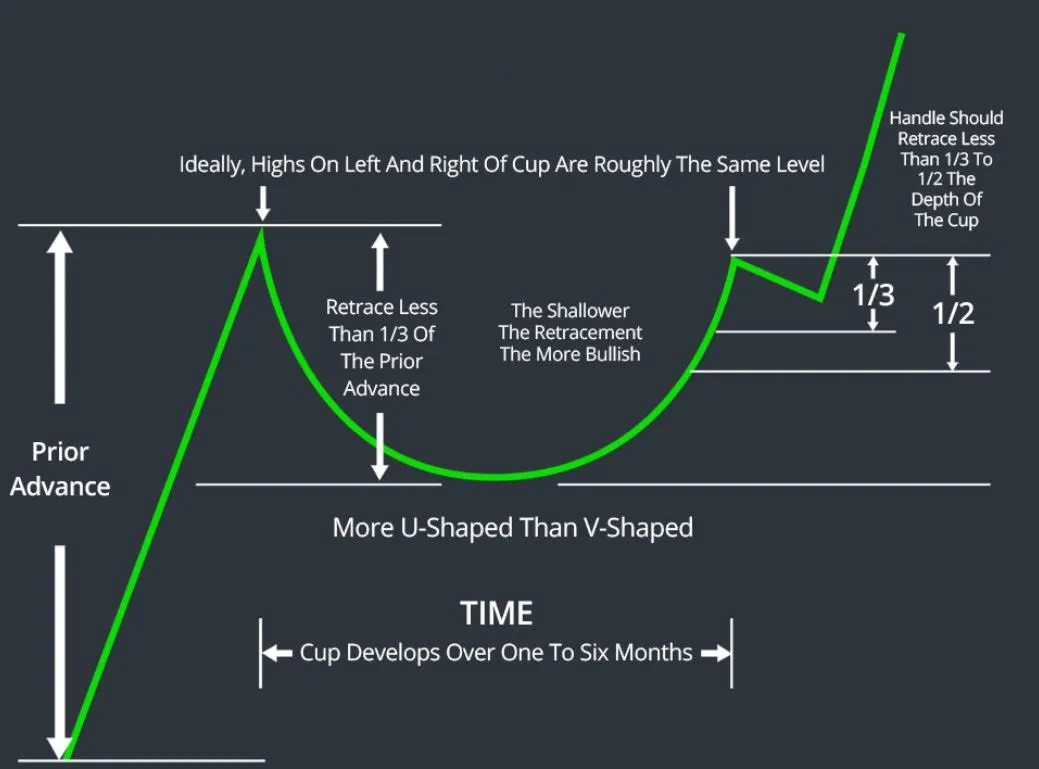

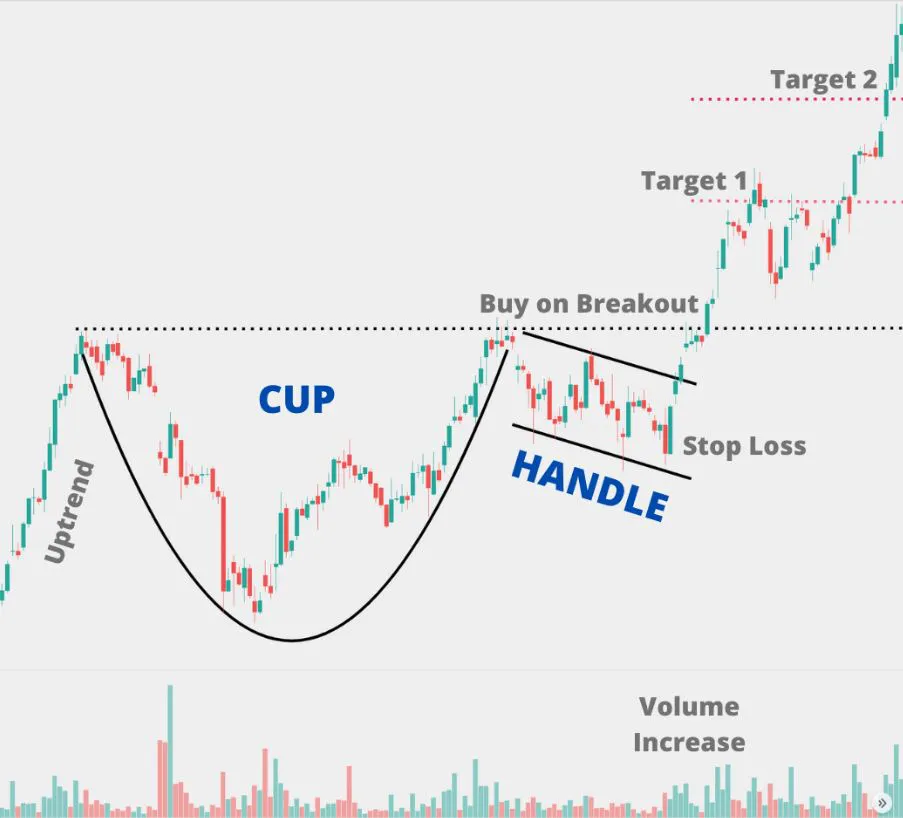

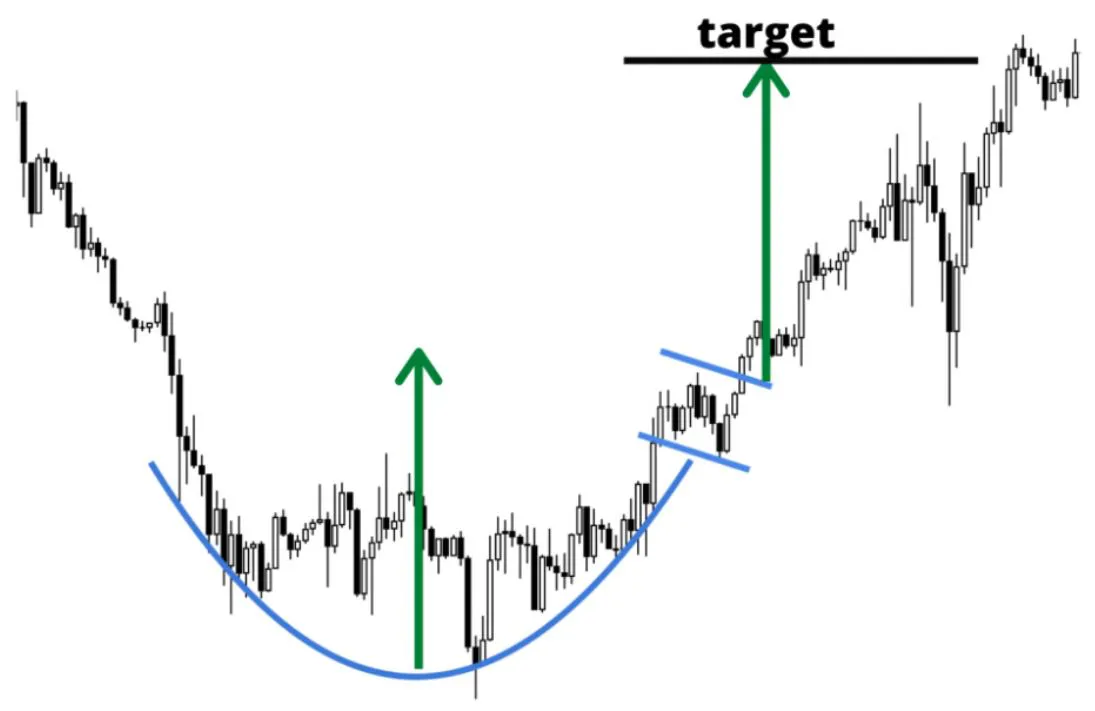

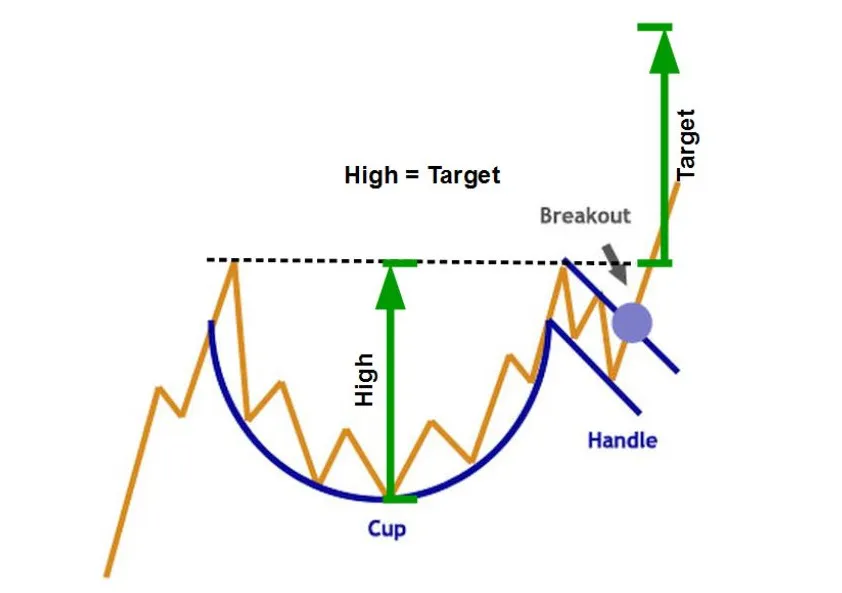

The cup and handle is potential bullish trend reversals pattern.

The pattern resembles a cup with a handle on the right side, hence its name.

The cup portion of the pattern forms when an asset's price drops sharply, then rises slowly and steadily, forming a rounded bottom over long time.

The handle portion of the pattern forms when the price of the asset drops slightly, forming a small dip or consolidation, followed by a smaller price increase, forming a smaller rounded top.

breakout above the handle portion of the pattern, which can be a bullish signal.