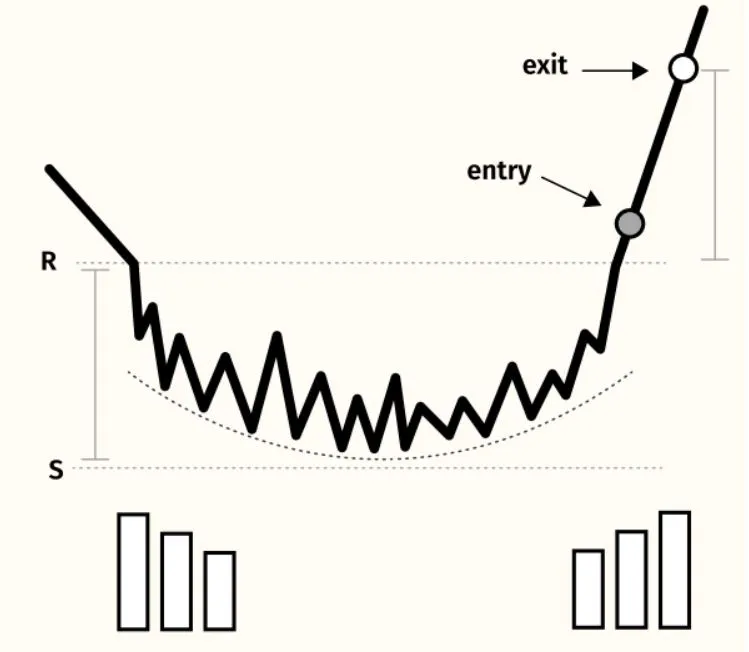

- Rounded Bottom

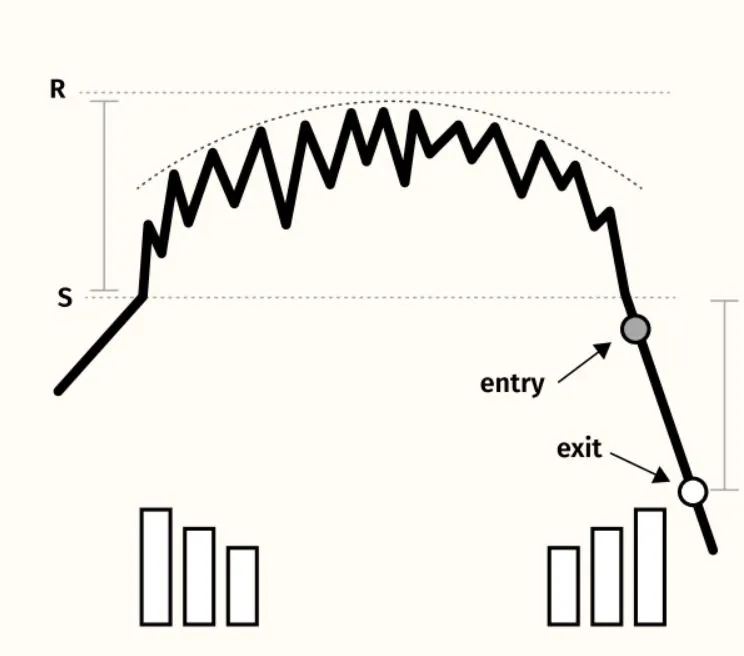

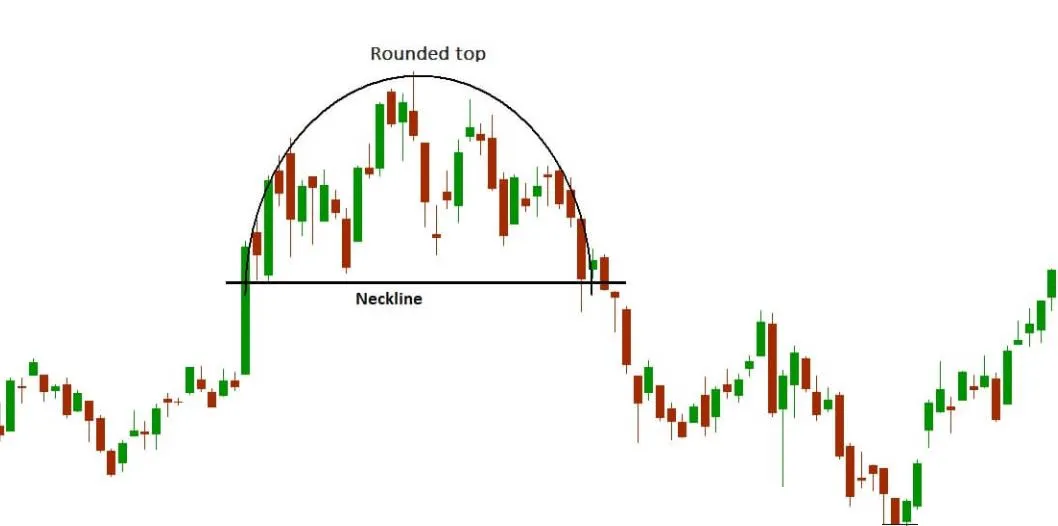

- Rounded Top

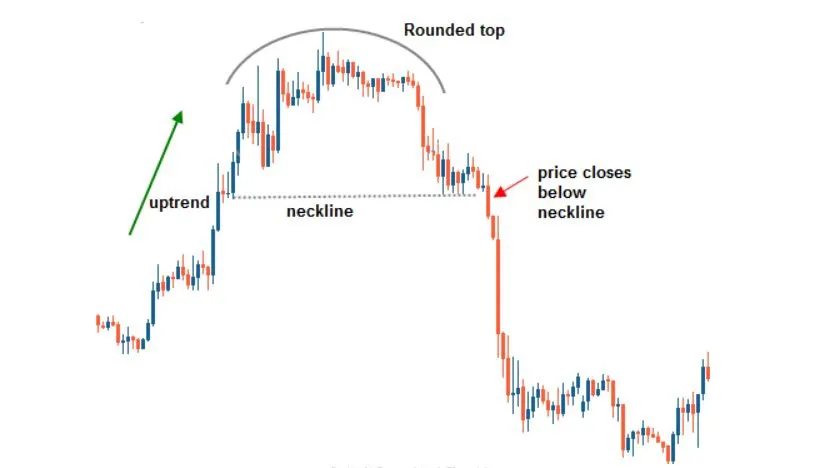

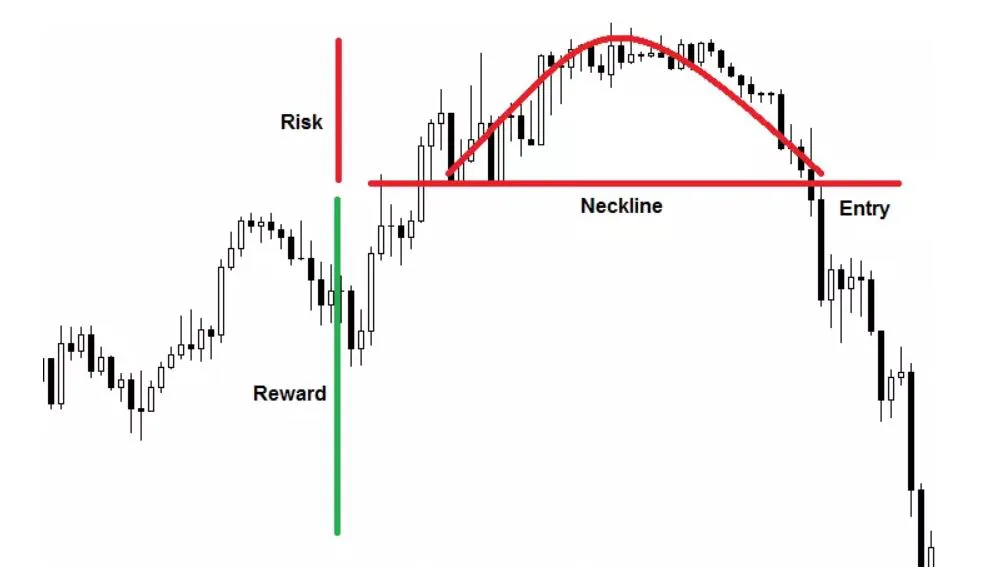

ROUNDED PATTERN

Rounded pattern is a technical analysis pattern that appears on price charts and indicates a potential trend reversal. It is also known as a "saucer" pattern and is characterized by a gradual, curved bottom in the price chart.

Traders and analysts use the rounded pattern to identify potential buying/selling opportunities, as it suggests that the current trend has ended and a new trend is beginning.