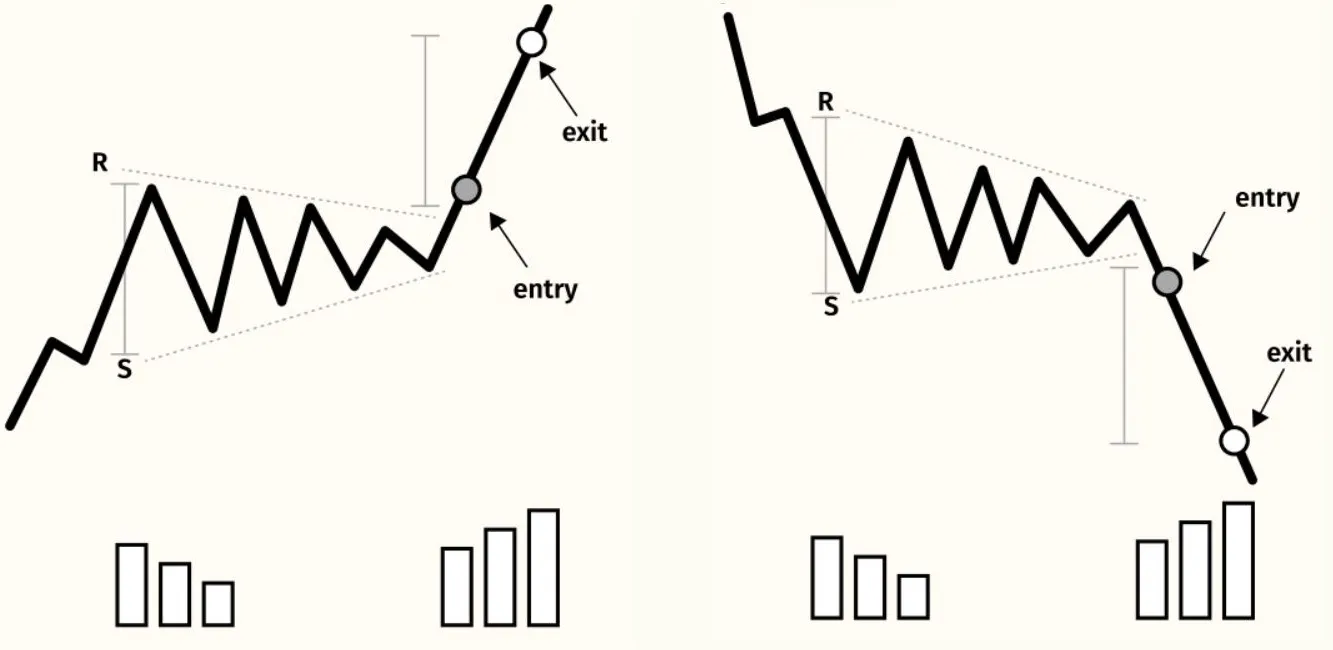

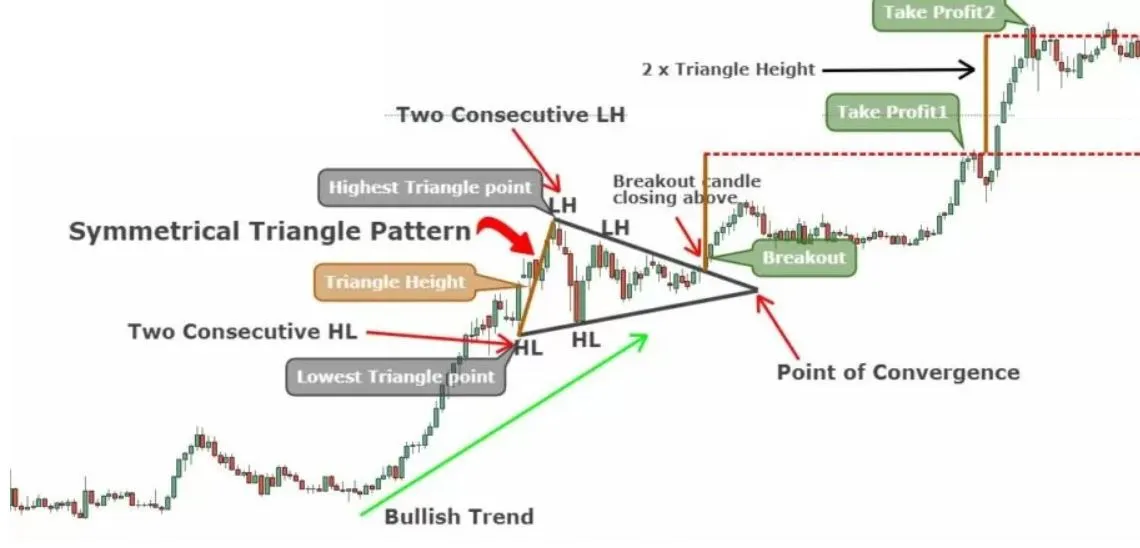

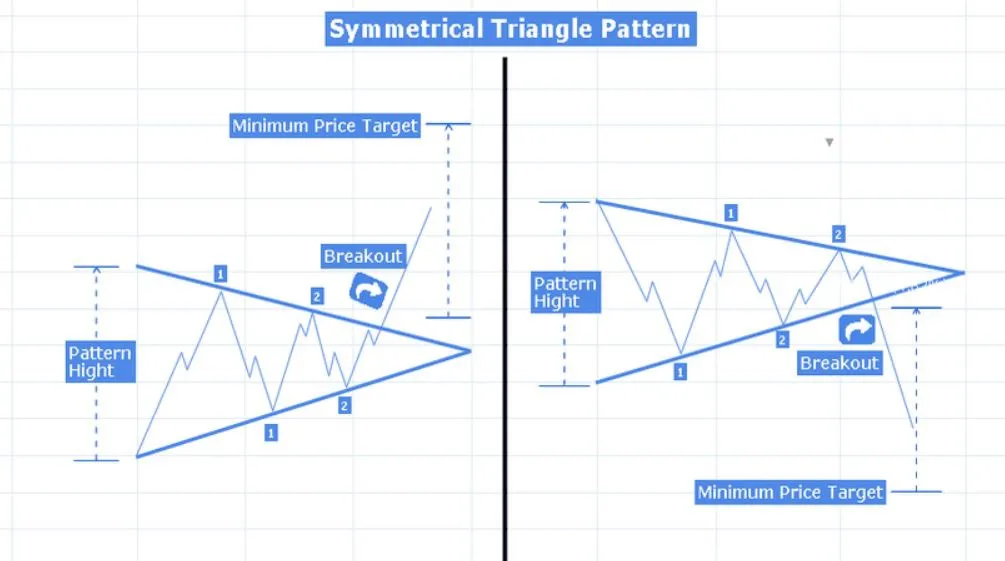

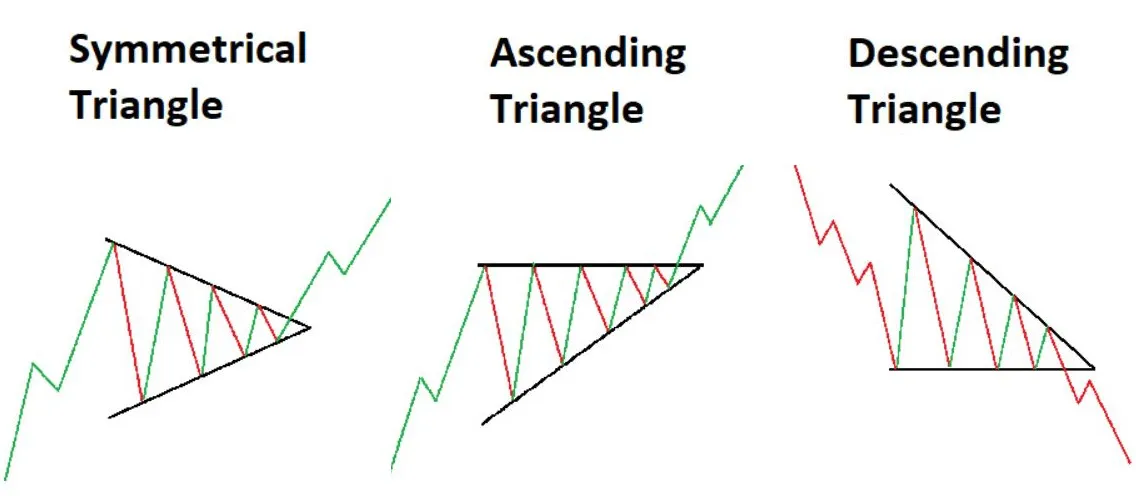

- Symmetrical triangle pattern

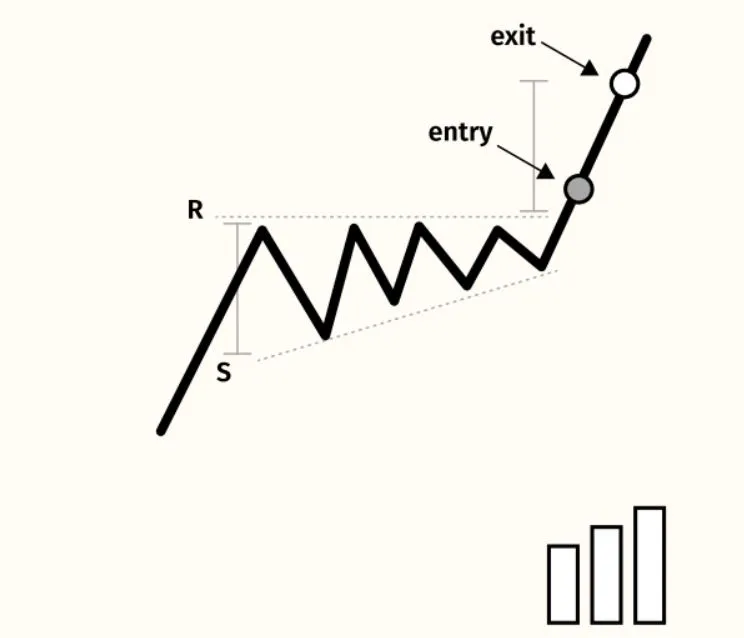

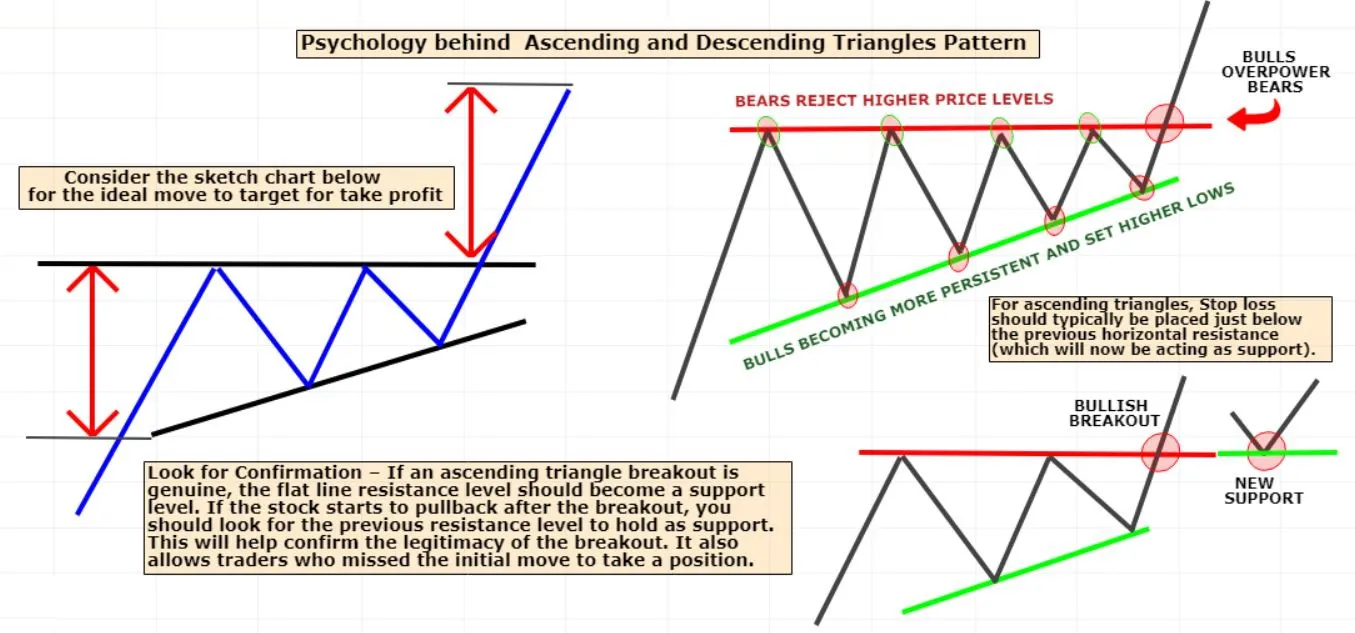

- Ascending triangle pattern

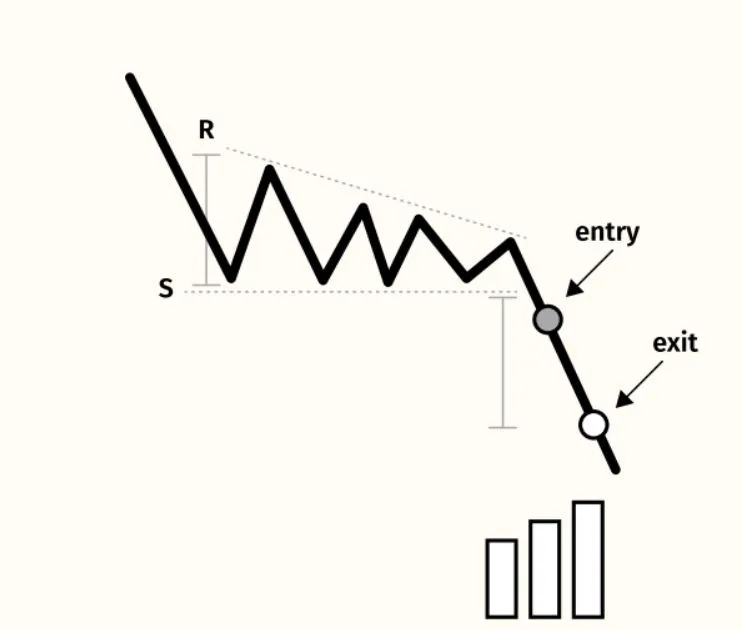

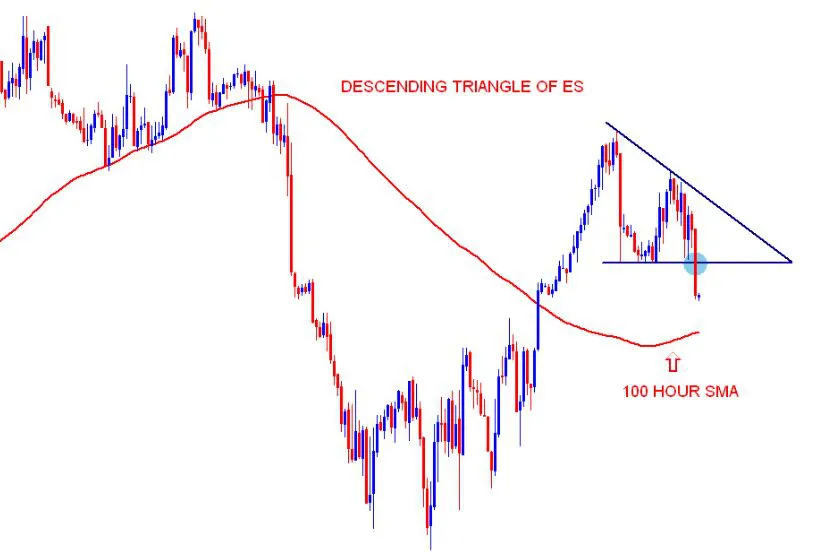

- Descending triangle pattern

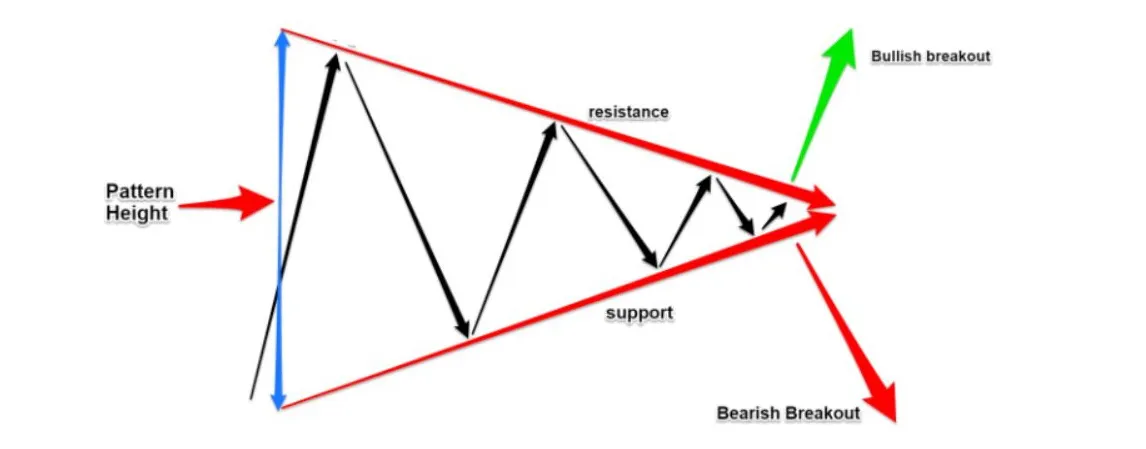

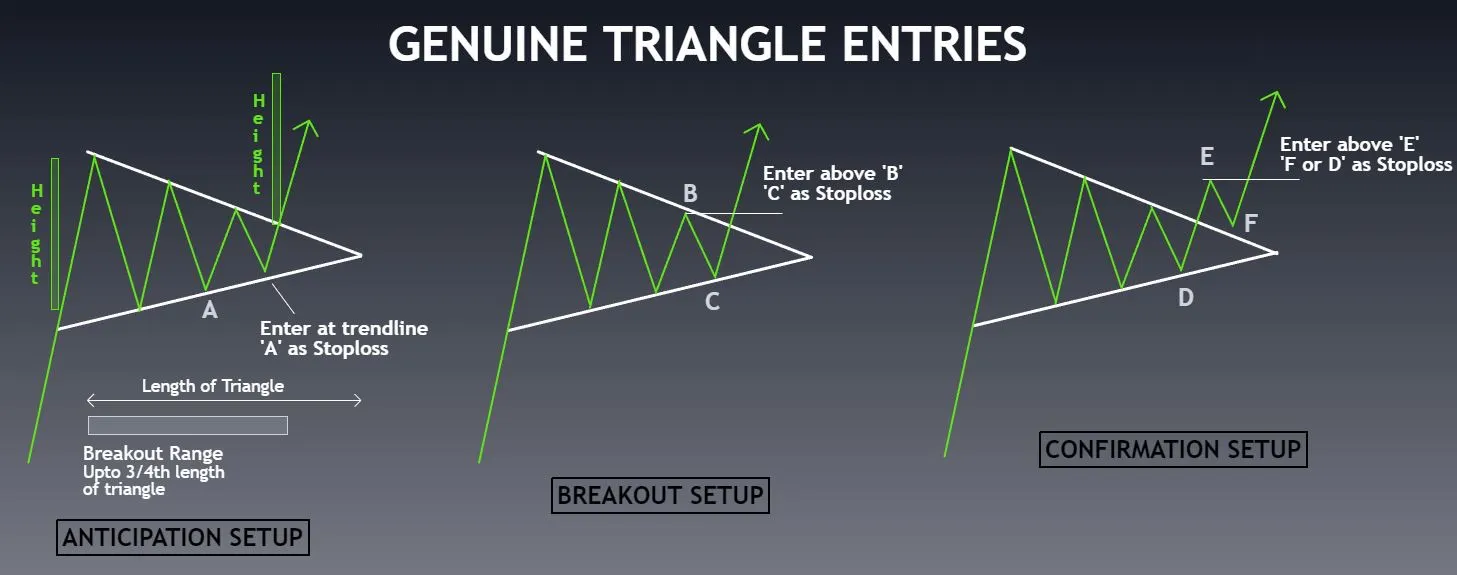

TRIANGLES

In technical analysis and price action, triangles patterns plays a main role.

A triangles pattern is a chart formation that occurs when the price of an asset moves within a converging range, forming triangle like structure on the chart.