-

Greed

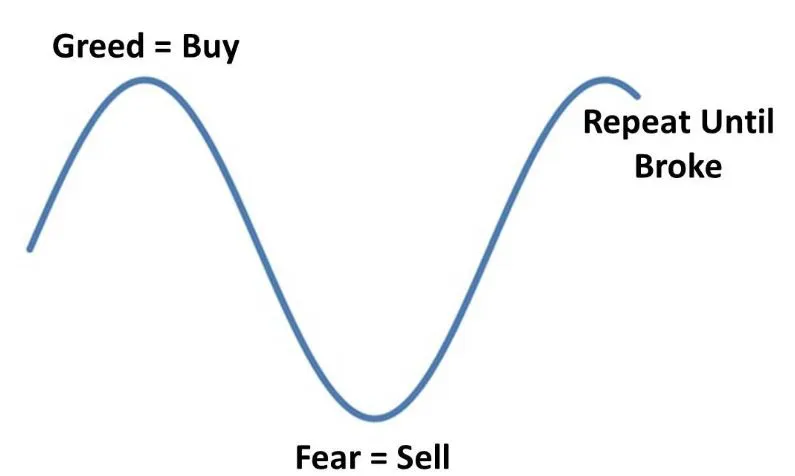

Most people jump into the stock market with the goal of making money, and that's totally fine! But sometimes, traders set their expectations way too high and expect quick riches.

Trading is a profession just like any other, and it requires focus, dedication, and hard work. It takes time to build success, just like any career path.

For instance, making $1000 from a trade with $100,000 capital yields 1% returns in a day. Repeating this success for a month brings over 20% returns. Consistency can double the capital in 5-6 months

But here's the catch - many traders don't think about the percentage returns on their capital. So they end up taking big risks or making unnecessary trades, and sadly, they end up losing a big chunk of their capital.

Remember, it's crucial to protect your capital because without it, you can't survive in the market. And, of course, making consistent profits is the key to success.

So, if you're beginner, don't rush into the market thinking you'll get rich overnight. Take your time, learn the ropes, and be patient.

-

Fear

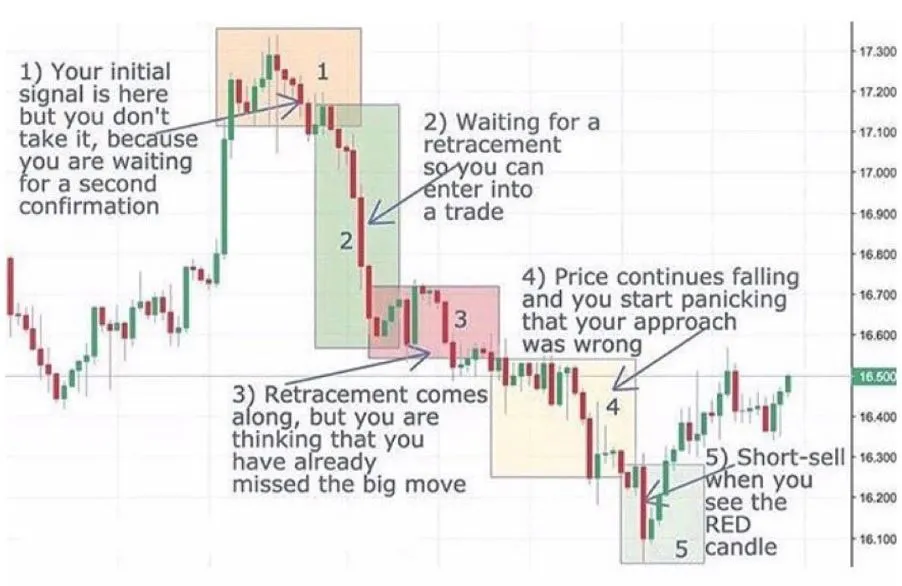

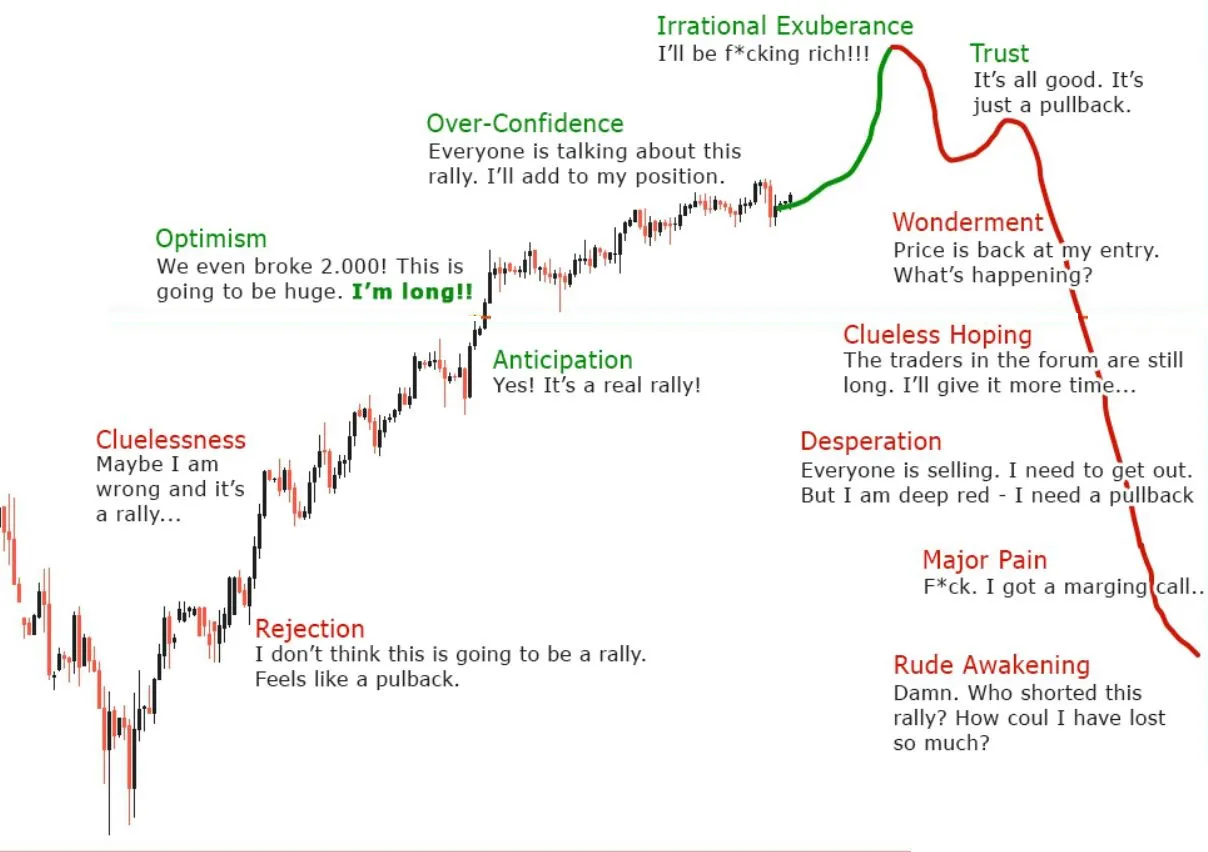

You know, many of our fears come from past bad experiences in trading. Like when you're all set to take a breakout trade, but there's this hesitation in your mind. It might be because you've lost money with Fake-outs before, and now your brain links them to pain, making you afraid to try again.

Sometimes, fear can also come from how we were brought up. If you grew up thinking that business is a bad thing, that belief might hold you back in your trading journey.

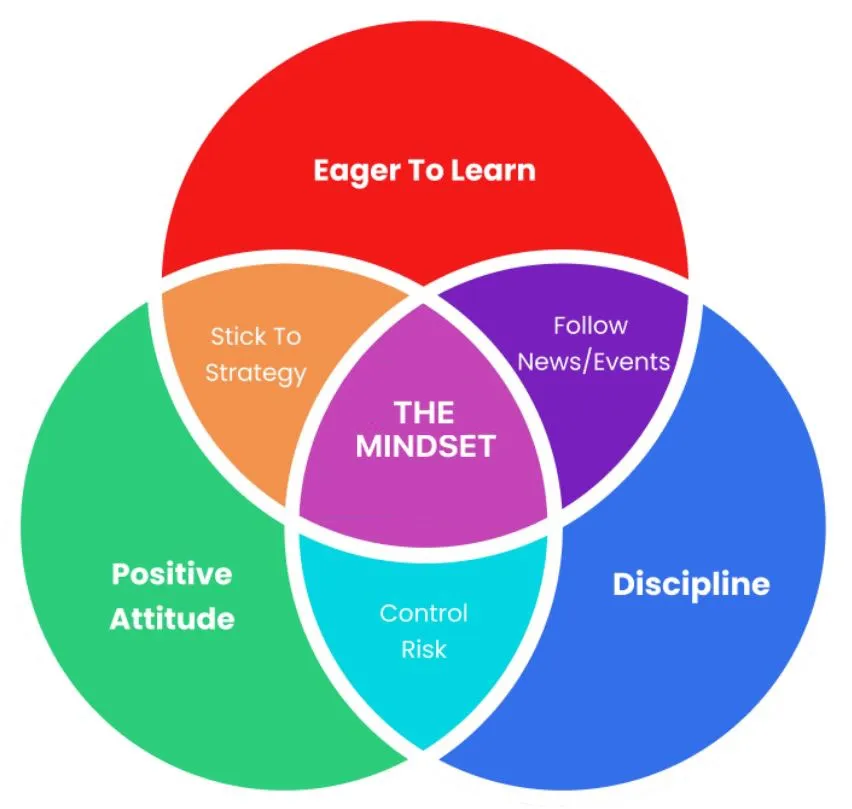

But don't worry, there's a way to overcome these fears! The key is to boost your confidence in trading. You can do this by backtesting your system with more data, reading books about trading, or taking a trading course that fits your needs.

And if you have fears related to your upbringing, it's crucial to identify and acknowledge them. Then you can use simple techniques like affirmations or practicing gratitude to work through them.

Remember, you're not alone in facing fears in trading. With a little effort and support, you can tackle them head-on and become a more fearless and successful trader!

-

Regret

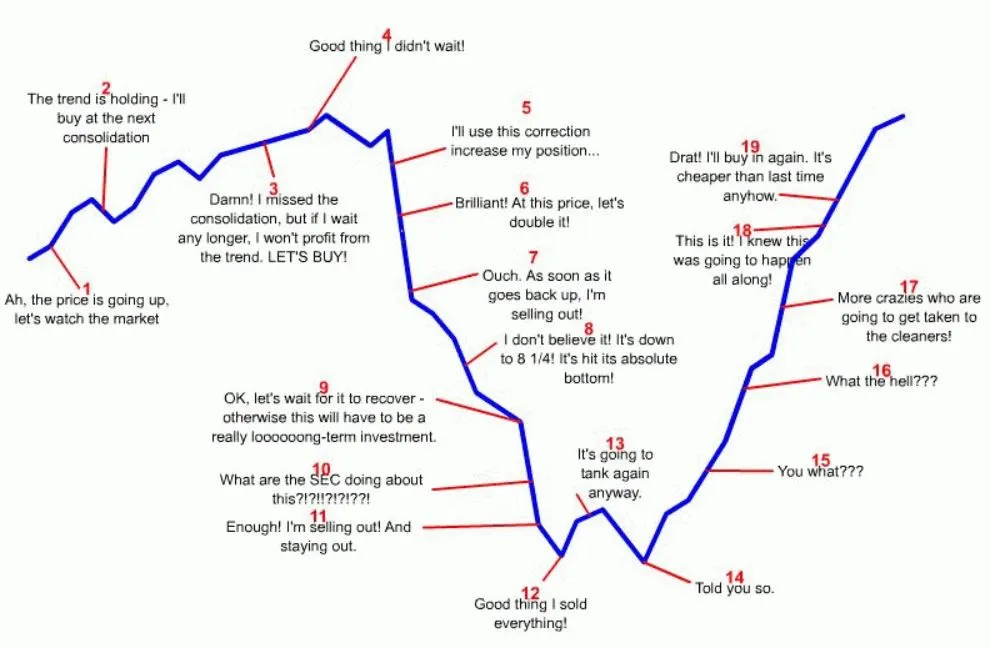

Imagine you close a trade, but the price keeps going up, and you start thinking, "Oh no, I should have stayed in!" Or, you hold onto a trade, hoping for even more profits, but it turns against you, and you think, "I should have taken my profits when I had the chance!"

But here's the thing - regretting decisions won't get us anywhere. The key is to plan your trades carefully and stick to your plan. Remember, it's impossible to catch every single great move in the market.

Instead of dwelling on regrets, focus on learning and improving. Take it one day and one trade at a time. Every trade is an opportunity to grow and get better at this game.

So, be kind to yourself, accept that not every trade will be perfect, and keep moving forward. Learn from your experiences, stay disciplined, and keep honing your trading skills. With time and practice, you'll become a more confident and successful trader!

-

Hope

Let's talk about hope in trading - it's something we all experience, but it can sometimes lead us down the wrong path.

Imagine a trader who has a solid plan for buying a stock at 200, setting a stop loss at 198, and booking profits at 204. So far, so good!

The price reaches 200, and he's in the trade - awesome! But then, it moves to 204, and instead of booking his profits as planned, he starts hoping for more. He thinks, "Hey, maybe there will be a short covering rally, and I'll make even bigger profits!"

But you know what happens next - the market takes a U-turn, and the stock price drops back to 199. Now, he hopes for a rebound, thinking, "It'll bounce back any moment now!"

Unfortunately, it keeps going down, below his stop loss level of 198. But he's still hoping for a turnaround, even when the price hits 196.

In this example, what happened? He lost control of his trading plan. When we deviate from our pre-planned stop loss and target, we're no longer in control. We start making decisions based on hope, which can weaken our trading strategy.

So, always be prepared with clear action points - your stop loss and target. Stick to your trade plan and act accordingly. The market presents plenty of opportunities, so don't get stuck hoping for one trade to turn around miraculously.

Remember, hope is great, but when it comes to trading, relying on it can lead to trouble. Stay disciplined and true to your plan, and you'll be on the path to more successful trades!