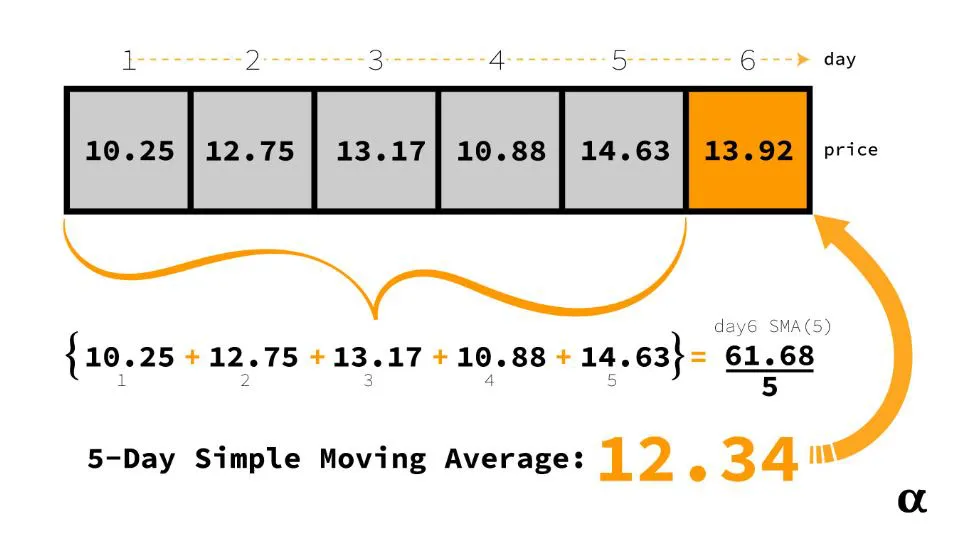

- SMA: Simple Moving Average

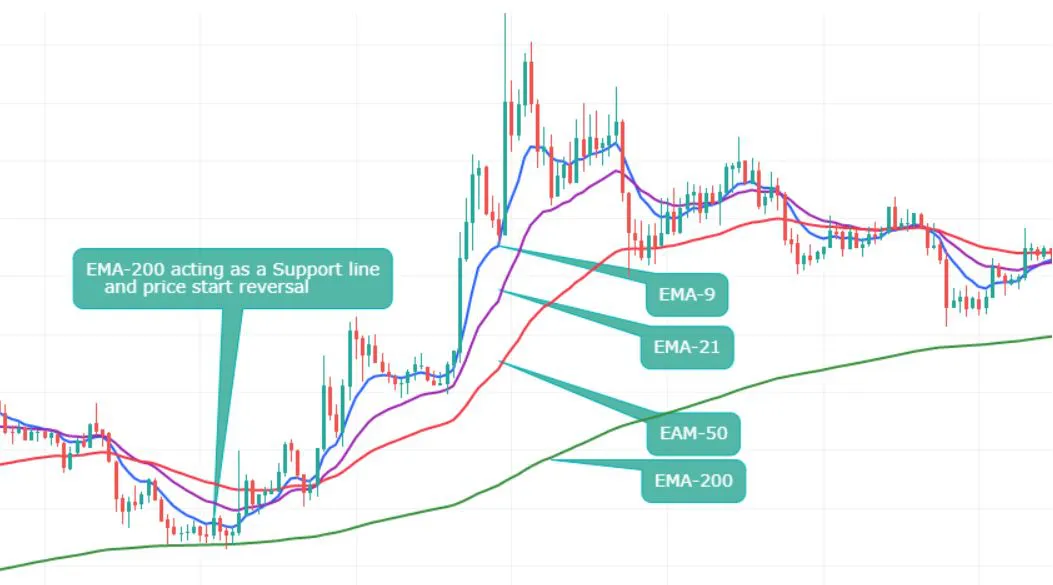

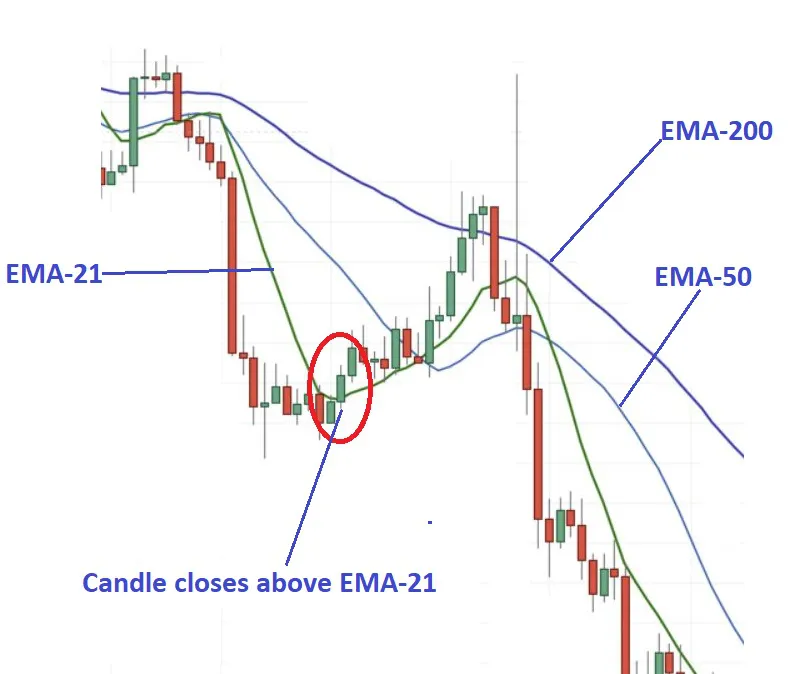

- EMA: Exponential Moving Average

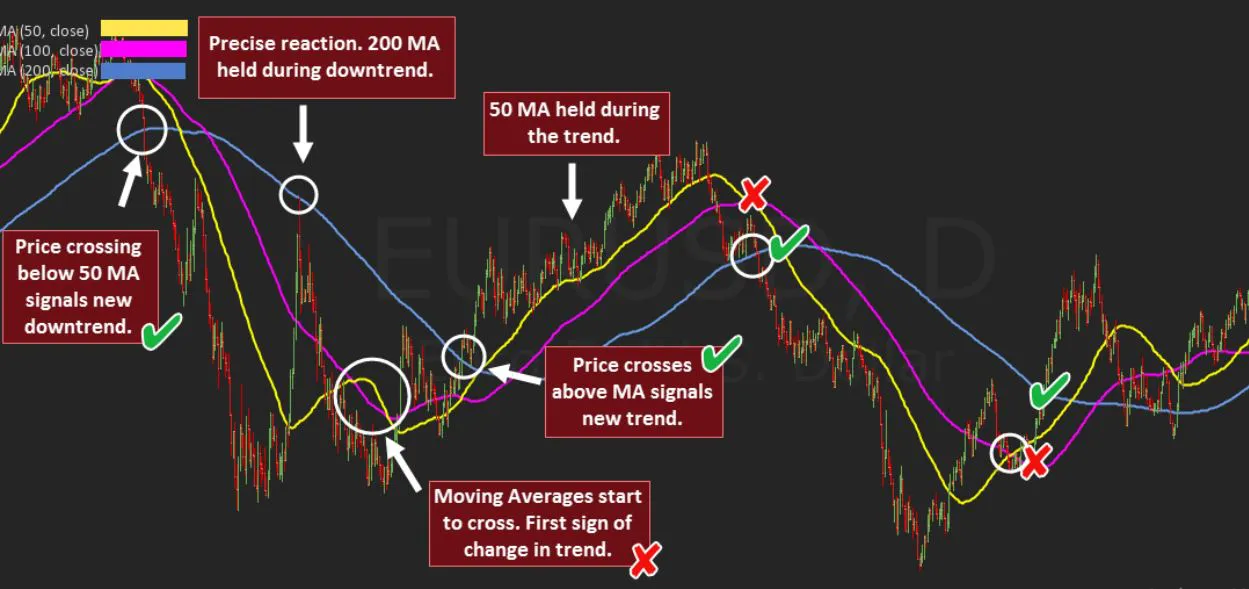

Moving Average

Moving averages are a way to figure out the average price of something over a certain amount of time in the past.

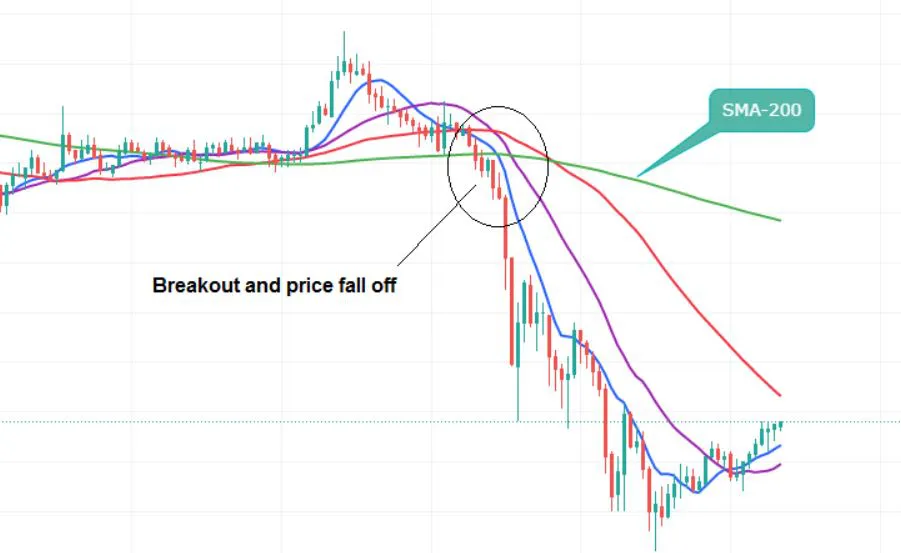

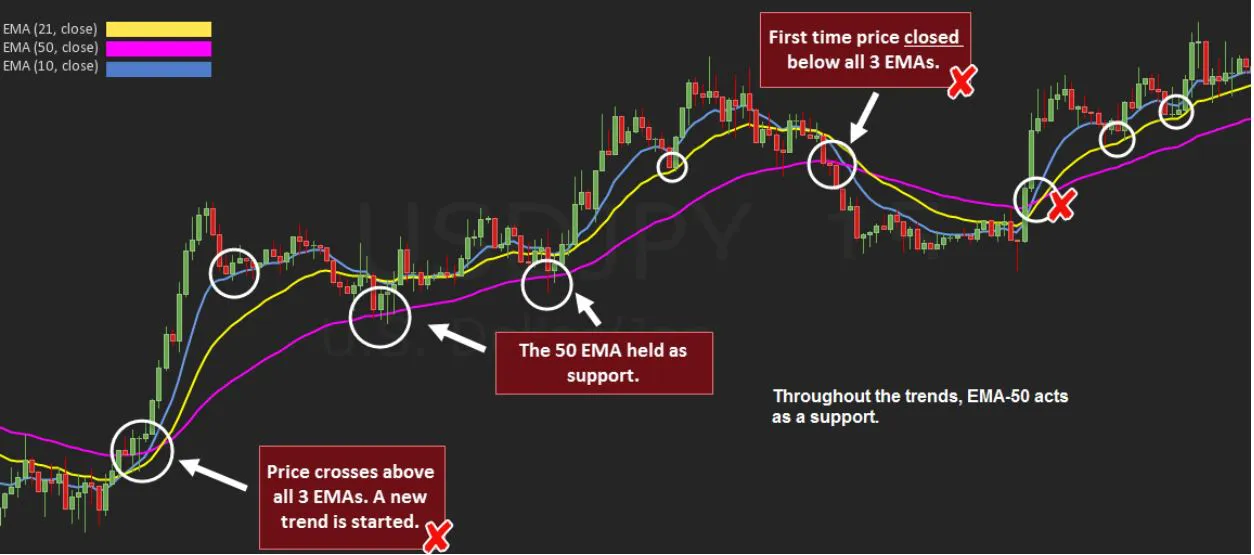

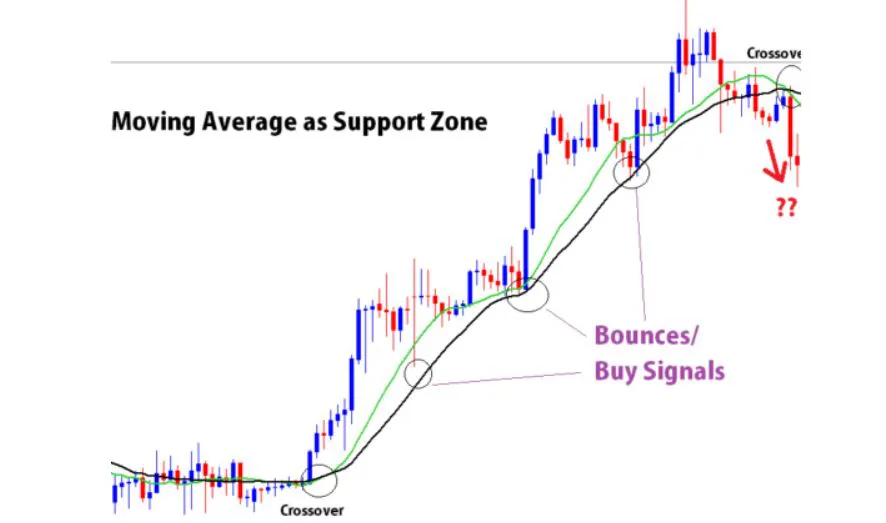

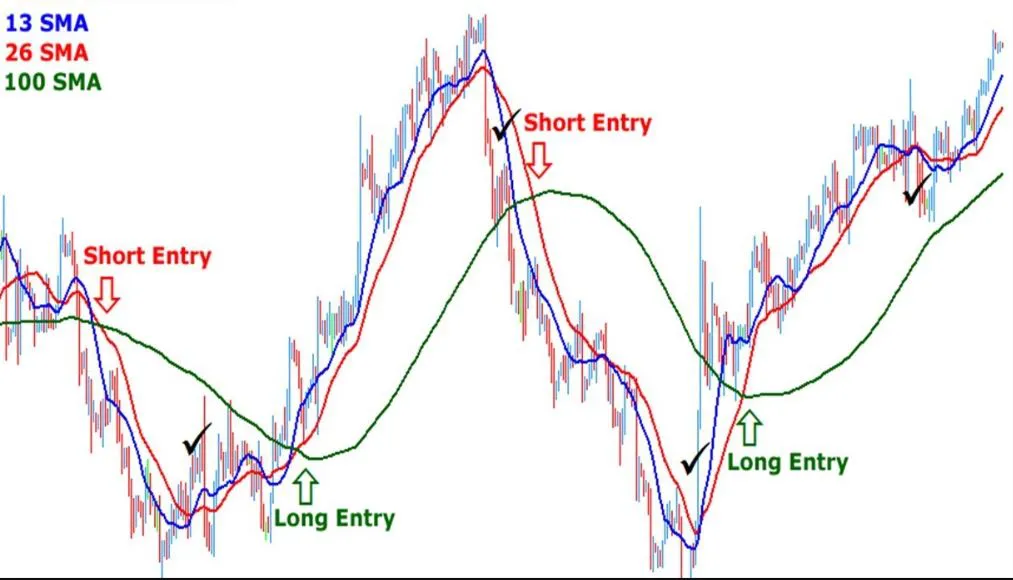

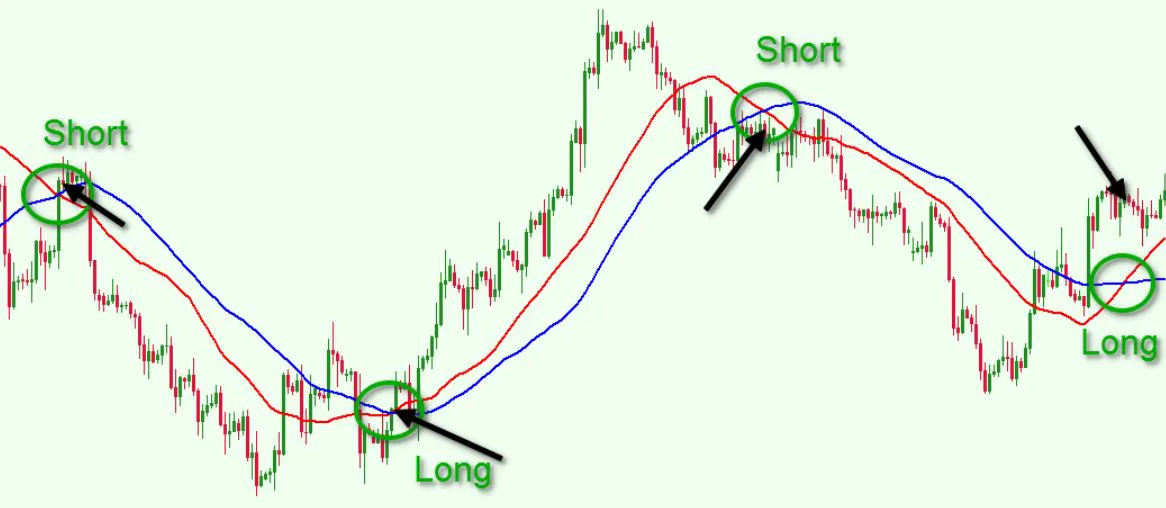

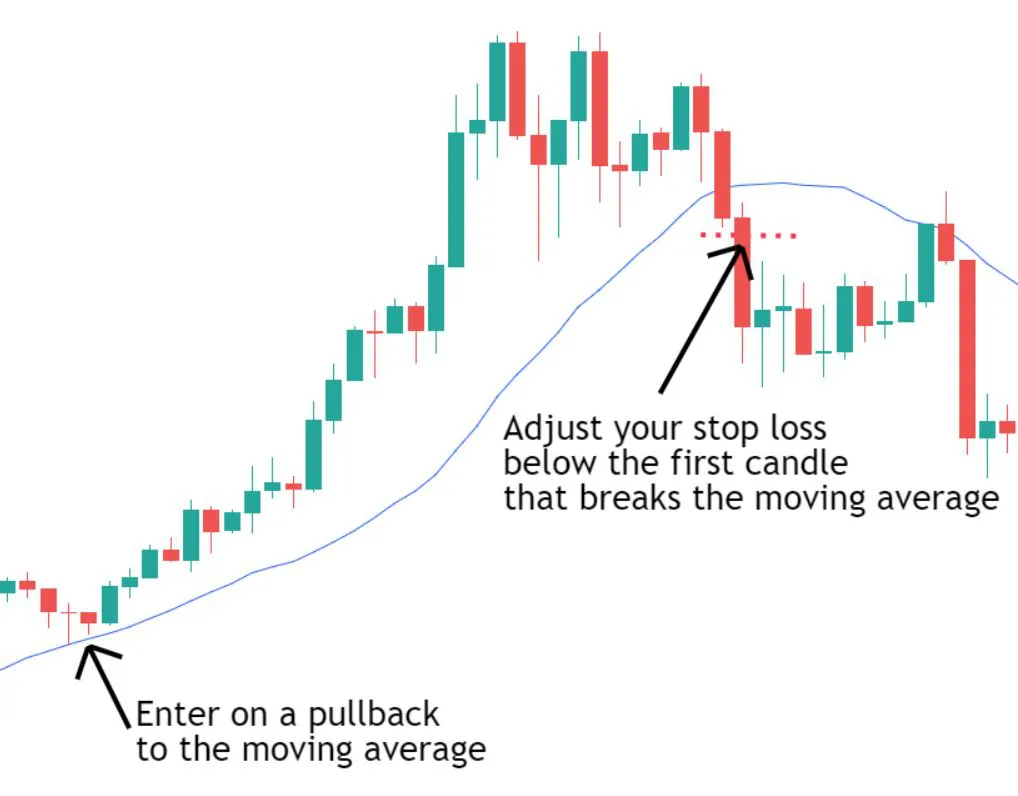

They can help predict where the price might go in the future by showing areas of support and resistance.

It reduces the price fluctuations or noise in the price chart so that the viewer can see the price movement smoothly without all the ups and downs.