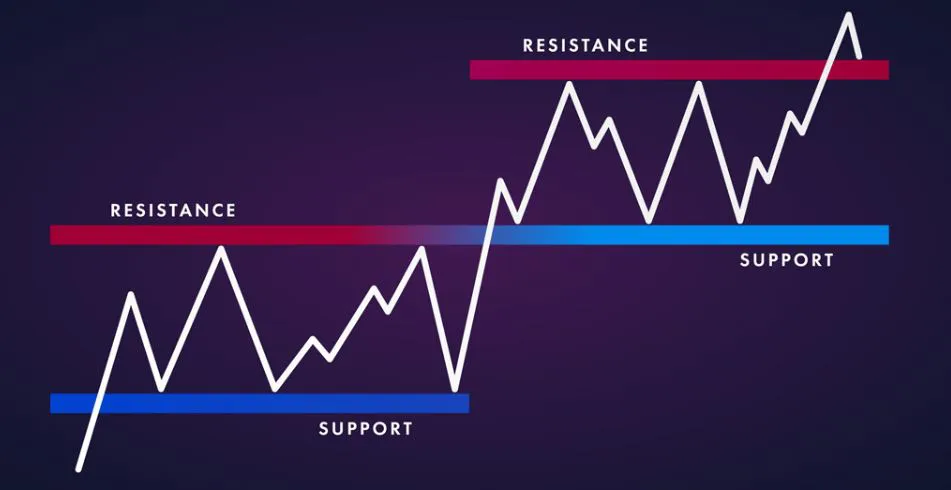

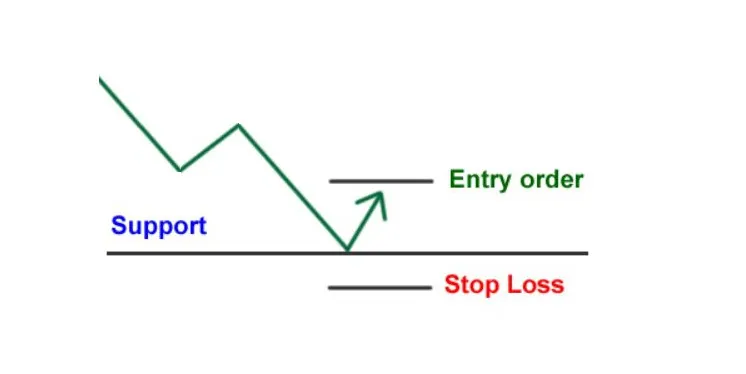

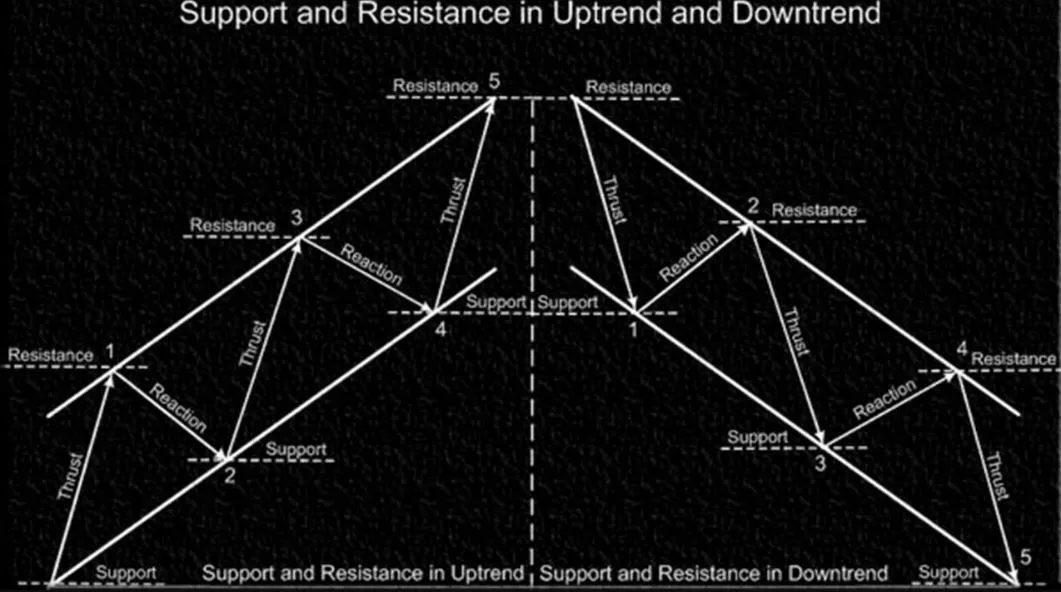

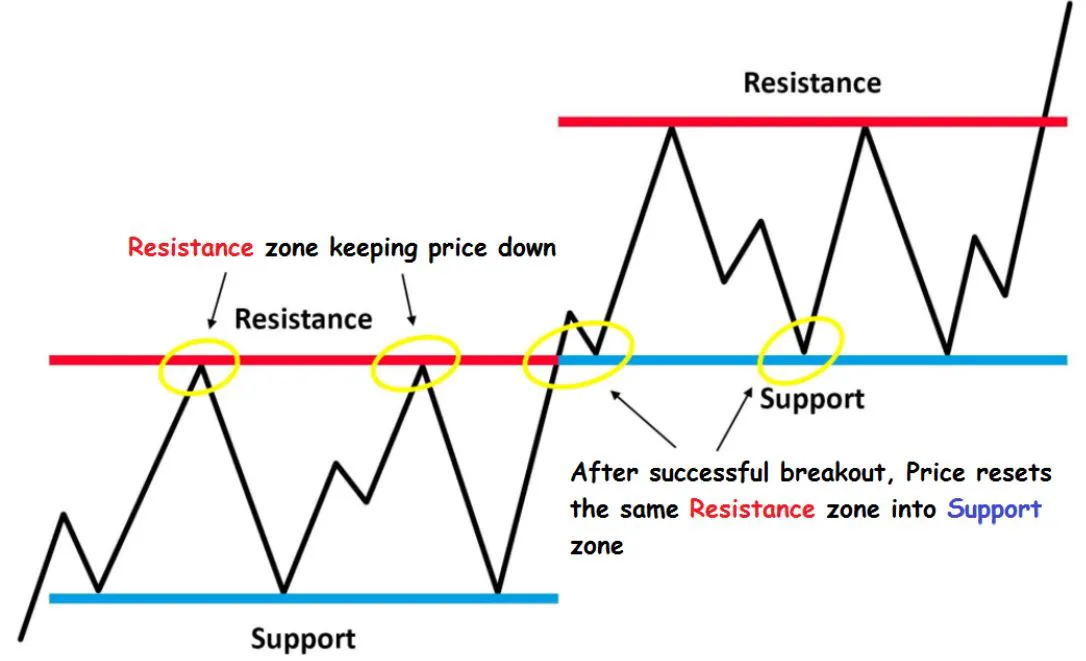

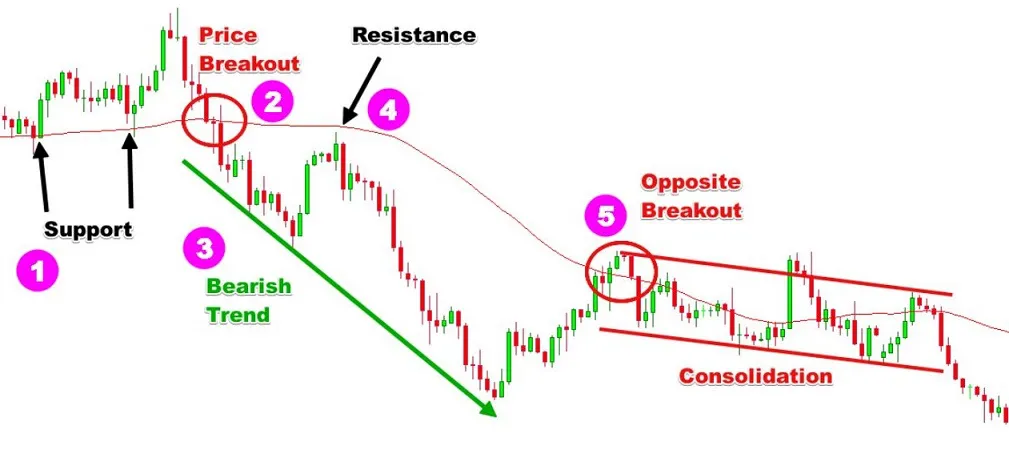

- Support is a level in the price of an asset where there's a lot of buying activity that prevents the price from dropping further.

- Traders often see support as a good place to buy because the risk of further losses is relatively low.

- The more times the price has been supported at a certain level in the past, the stronger that level is seen by traders.

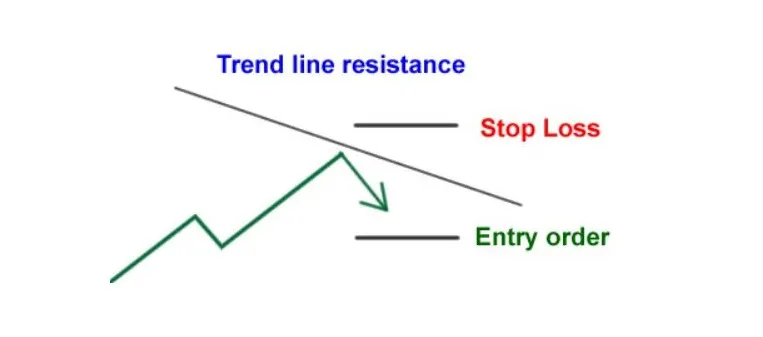

- Support is a price area on a chart, where Supply is located

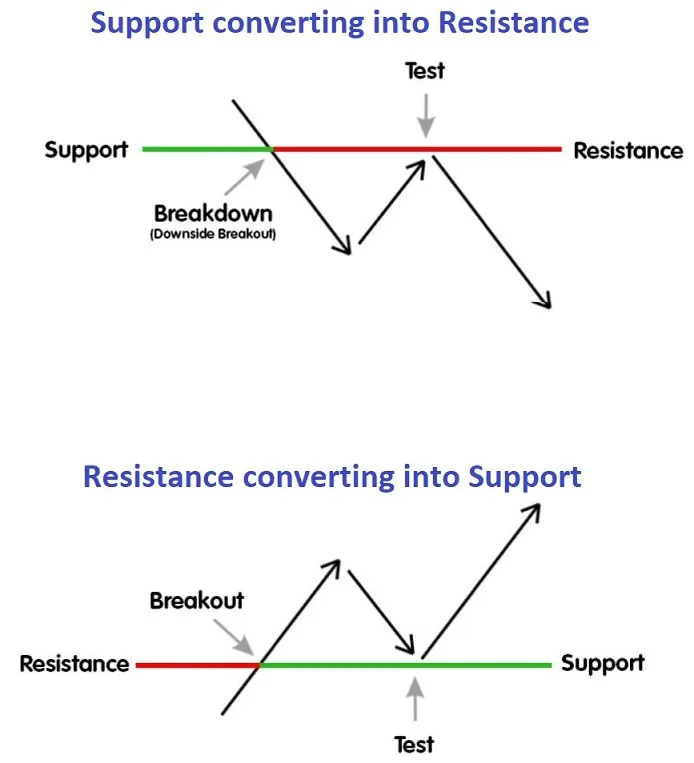

- If the price breaks through a strong support level, traders may interpret this as a bearish signal, indicating that the asset may continue to fall.